This is the eleventh post of the series, where I will share notes taken by me while reading the annual reports of this business. I will be sharing an excel sheet at the end of the series which will capture all the relevant data throughout the years of its operation. Notes will mostly contain intangible non-financial data which will reveal subjective characteristics of the business and management. I have restrained from adding my comments and recommendations on specific subjects as I do not want to introduce my biases in this exercise. Shorthand abbreviations are used from time to time and should be logical. For any clarification, please use the comments section. This is not a buy or sell stock recommendation, just an exercise in researching and understanding the business.

Won 3rd best place to work in India and 10th in Asia (only Indian organization in the list), #1 in MFI.

Won Platinum SKOCH award for inclusive insurance, based on the company’s financial inclusion initiatives, exceptional customer service, insurance penetration and for covering the highest number of lives through insurance. Ujjivan’s focus on Education through its Common Group Training and Financial Literacy program, Assured Reach and Access, backed by a 100 % claim settlement ratio were the key factors instrumental for it winning this award. Ujjivan was also awarded the SKOCH Order-of-Merit for qualifying amongst the Top 100 Projects in India.

Ujjivan Financial Services

Message from Chairman

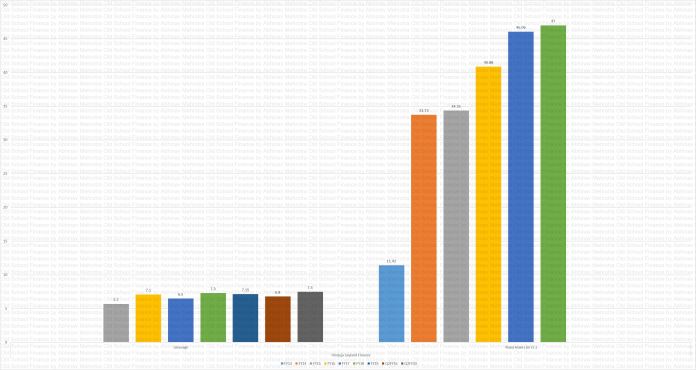

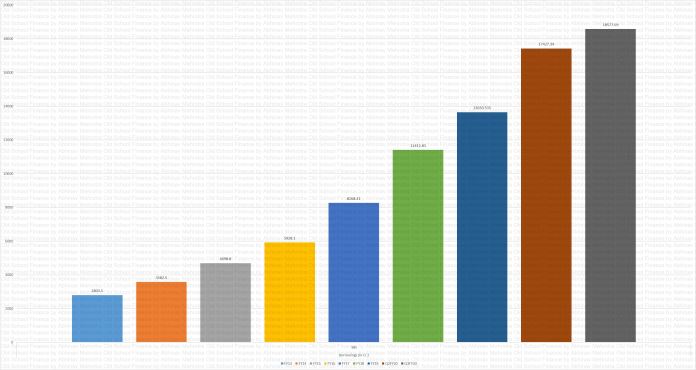

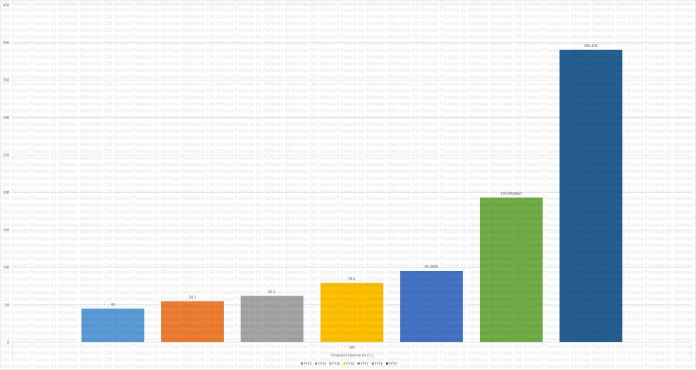

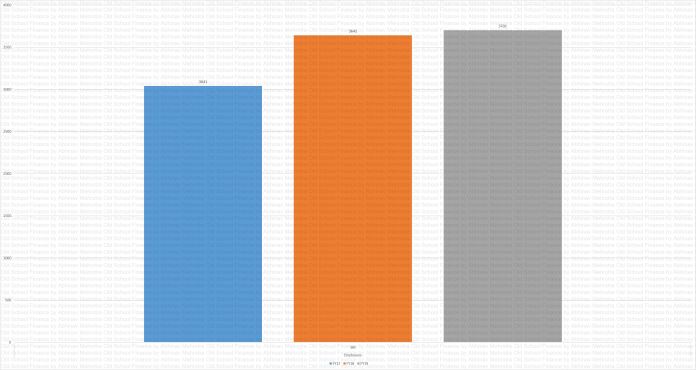

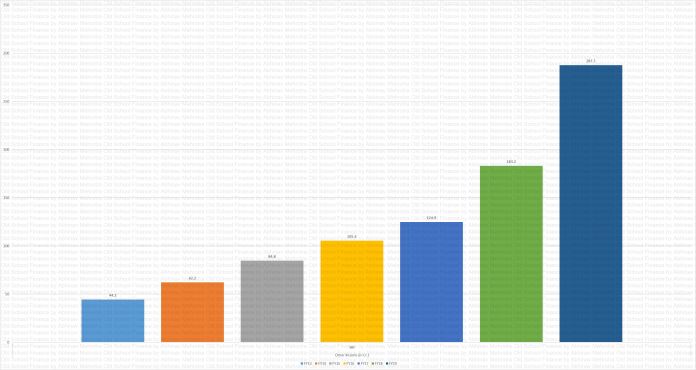

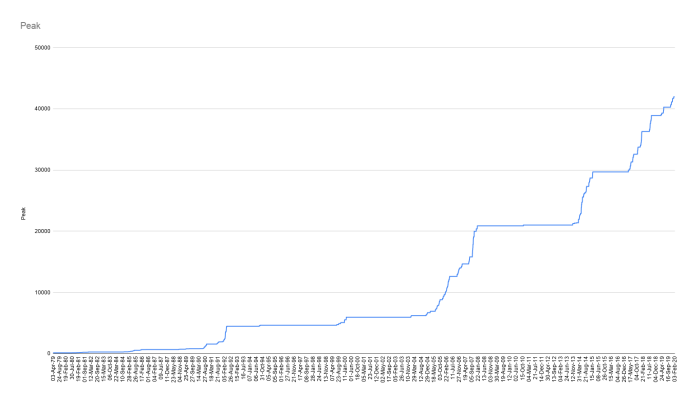

From modest beginnings in 2004 your company has emerged as one of the largest MFIs in the country in terms of geographical spread with pan India presence through 470 branches across 24 states and 209 districts and a loan book of around Rs 6500 crore, serving 36 lakh customers. We have not swerved from our mission and remain totally dedicated to serve the financially unserved and underserved community. We have consistently earned customer accolades by forging strong, meaningful & empathetic relationship with our customers, thanks to our dedicated front line and service quality teams. As a service entity, we are always conscious that human resources are our greatest assets and our organizational human resources policies and practices mirror this.

Why did we become a Bank may be the upper most question that may linger in your minds. Lack of access to savings is often referred to as the “forgotten half of rural finance”. More than the “loans”, the poor need a trusted formal saving channel, shorn of rigidities, to keep their savings. Savings should precede loans. Due to regulatory constraints, hitherto as a non-banking finance company, Ujjivan was not permitted to accept deposits from customers. In our broadened role as a bank, we can provide savings products apart from loans and other financial products with which two benefits will accrue.

Firstly, our access to savings from customers and public at large will reduce our funding cost, which in turn could benefit the borrowing customers by way of lower interest. Secondly, once our customers inculcate savings habits, they would be able to better manage their cash flows and avoid over-indebtedness and consequent debt traps.

Why two separate entities “Ujjivan Financial Services Limited” and “Ujjivan Small Finance Bank Limited” (hereinafter referred to as “USFB” or the “Bank”) could be the other question that may arise. One of the key regulatory requirements for setting up a small finance bank is that the promoters/promoter group should at least hold 40 per cent of the paid up capital of the bank, which should be locked in for a period of five years. Rationale for this regulatory prescription is possibly to ensure “stability in the shareholding of the bank” in the initial years of formation. As Ujjivan did not have any promoter/ promoter

group, we opted for the “Holding Company Structure” and transferred our operational business undertaking comprising of the assets and liabilities to “Ujjivan Small Finance Bank” through a slump sale. Post formation of Ujjivan Small Finance Bank, Ujjivan Financial Services Ltd., the Holding Company will be registered with the RBI as a NBFC-Core Investment Company. As the holding Company it will exercise its oversight function, provide support and funding within the legally permissible ambit thus managing its investment in the bank.

Mr Samit Ghosh assumed the leadership mantle of the Bank as Managing Director & Chief Executive of the Ujjivan Small Finance Bank, with the prior approval of the RBI. Ms Sudha Suresh, formerly the CFO of the Company, assumed charge as the Managing Director and CEO of your Company.

The major disruptive event we faced during the year, perhaps in our decade long journey, was “demonetisation”. While the move will yield positive benefits to the economy and the public at large in the medium term, the immediate negative fallout has been on a vulnerable sector like microfinance business. Given the fragile cash flows of our customers, their income and business activities were severely affected across various pockets. The resultant impact has been lower collection efficiencies and increase in Portfolio at Risk. Closely on the heels of demonetisation, loan waivers announced by some state governments for agricultural borrowers raised the expectations of microfinance borrowers too. Relentless efforts are on to educate and persuade the borrowers to adhere to repayment schedules. In justifiable causes, loans are restructured. There has been positive support from the industry network and Governments through appropriate media announcements. Loan collections are picking up gradually and we expect the situation will improve in the months following.

Letter from MD – Sudha Suresh

‘Ujjivan Small Finance Bank Limited’ was incorporated on July 04, 2016 as a wholly owned subsidiary of the Company. The Company, then submitted an application to the RBI for grant of banking licence to its subsidiary and based on the application submitted, the RBI issued Ujjivan Small Finance Bank the Licence No. MUM 123 dated November 11, 2016 to carry on Small Finance Bank business in India. Pursuant to the receipt of various approvals from the RBI including the approval for the Board and host of other registrations and regulatory compliances on which the licence was granted, ‘Ujjivan Small Finance Bank Limited’ commenced its operations as a Small Finance Bank with effect from February 1, 2017.

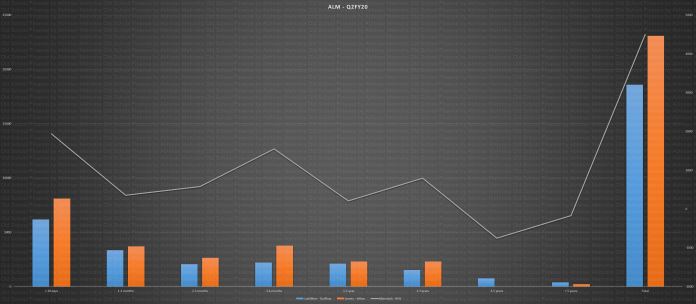

Ujjivan always had a robust risk management framework for its operation as a MFI. With the transition to a bank, we set up an independent Risk Management & Compliances department to manage various risks and compliances . Apart from the controls for Ujjivan’s existing lines of business as a MFI, we set to address additional risks as it transitioned to new products, IT systems and processes aligned to the banking requirements with requisite softwares and systems. This included EGRC and ALM solution for effectively monitoring various aspects of Credit, Market, Liquidity, IT and Operational risks. Compliance framework focused both on micro level obligations for branches and departments and macro level management of regulatory/statutory interactions, regulatory audits, policies, products etc.

Post the receipt of the final license from RBI on Nov 11th 2016, the team were all set for an exciting journey obtaining various approvals and licenses from RBI and other authorities. There were around forty approvals and permission including Bank Code, INFINET, RTGS ,NEFT ,Rupay, NFS, IMPS,AEPS, RBI Current Account ,SGL etc. required for the launch of the bank.

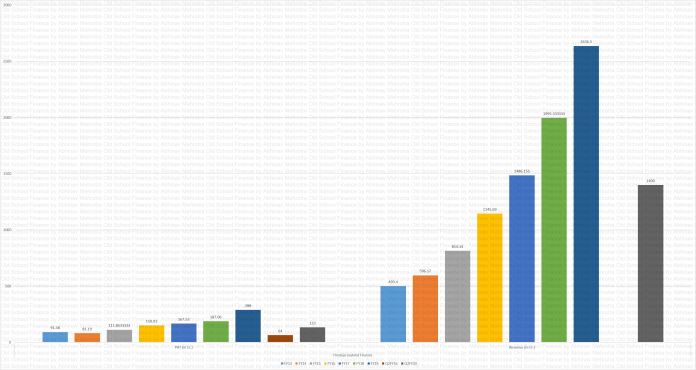

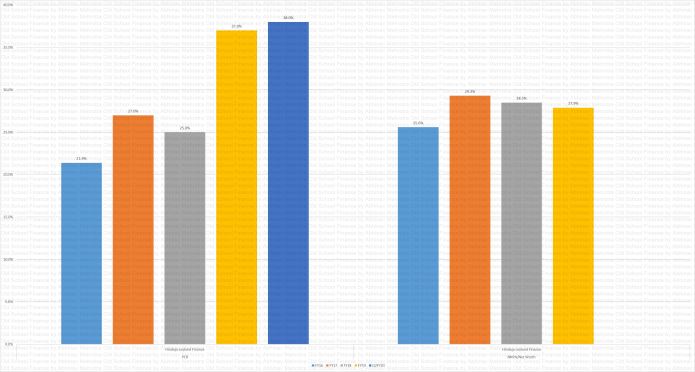

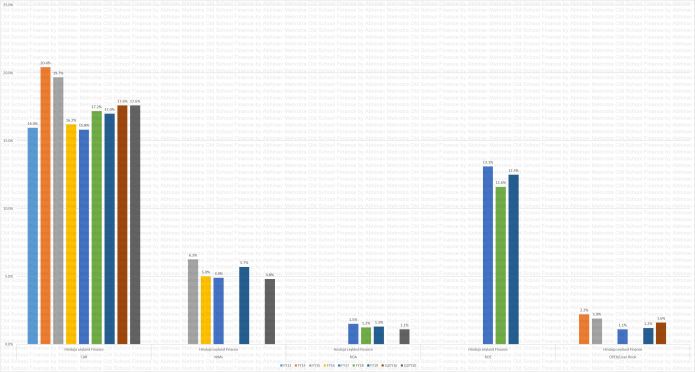

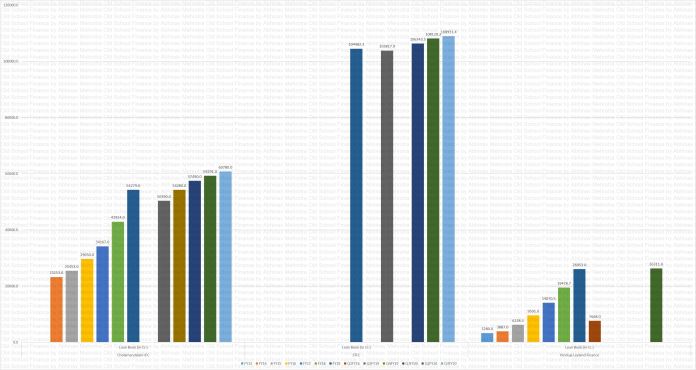

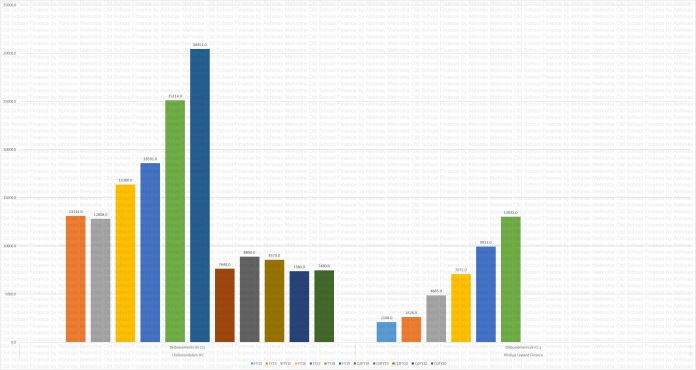

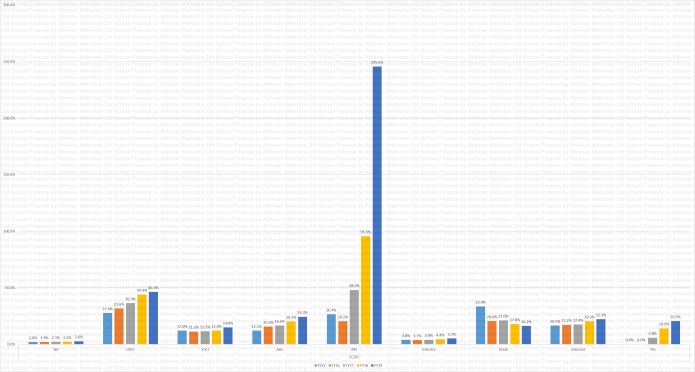

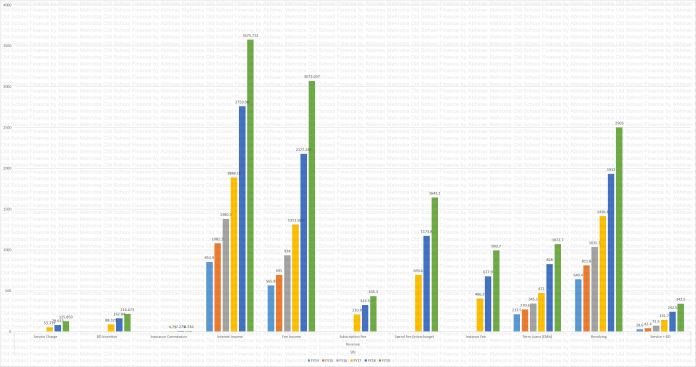

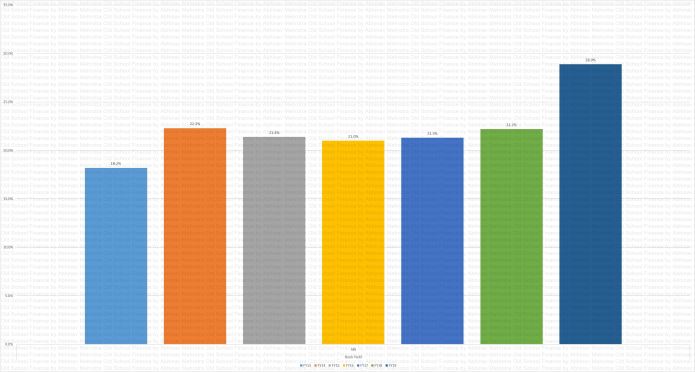

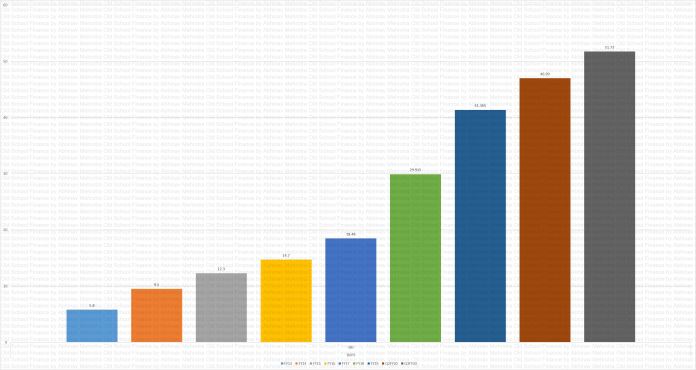

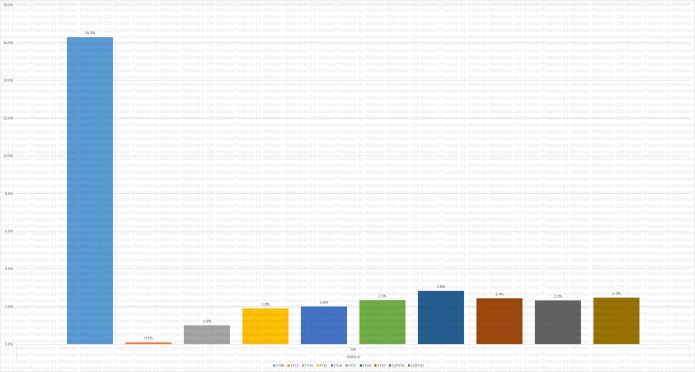

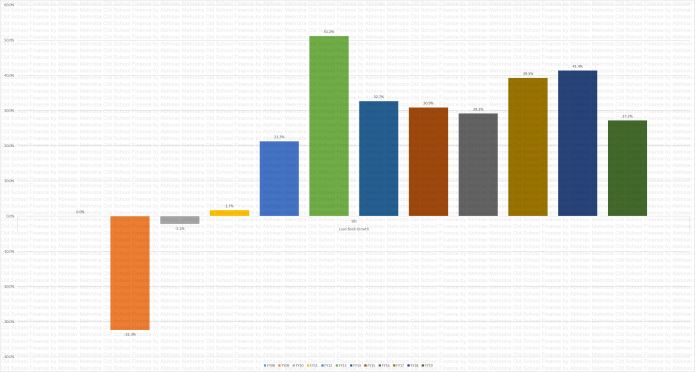

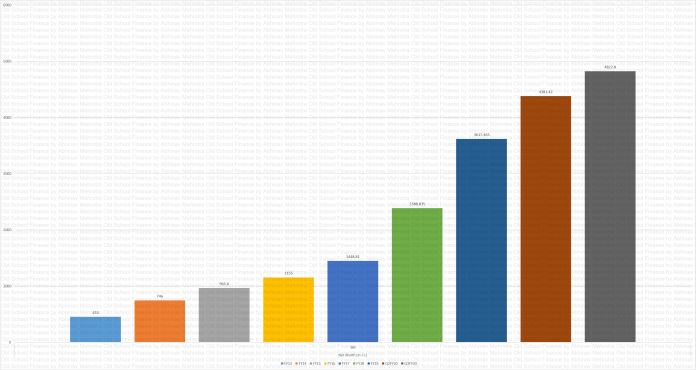

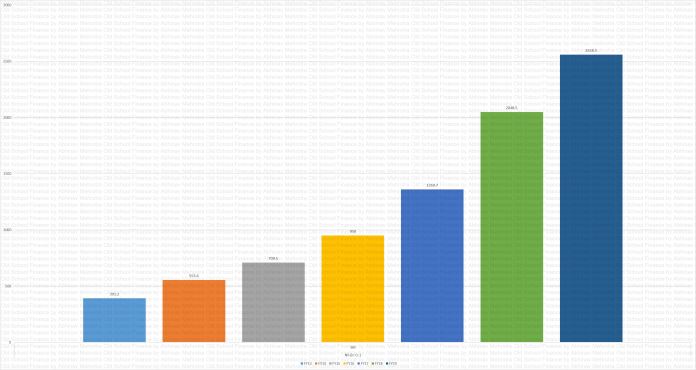

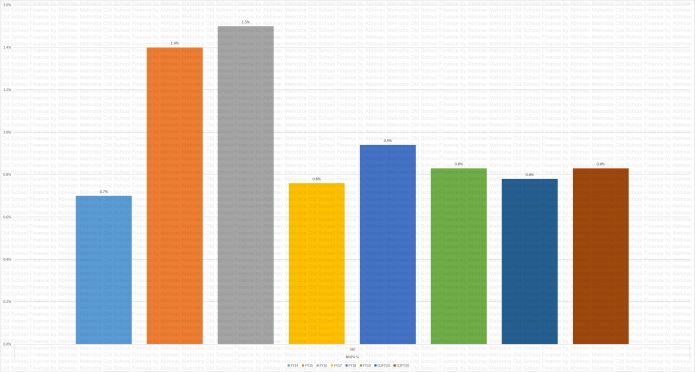

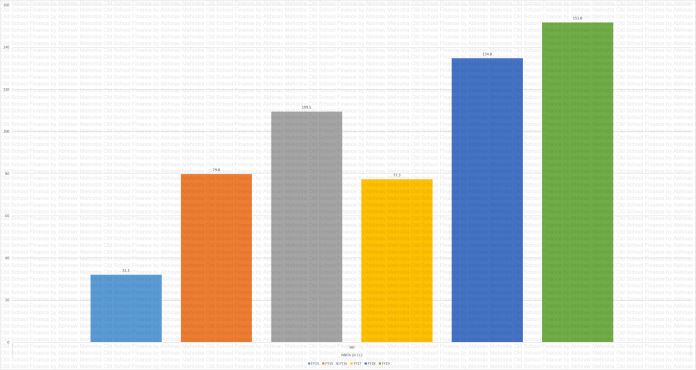

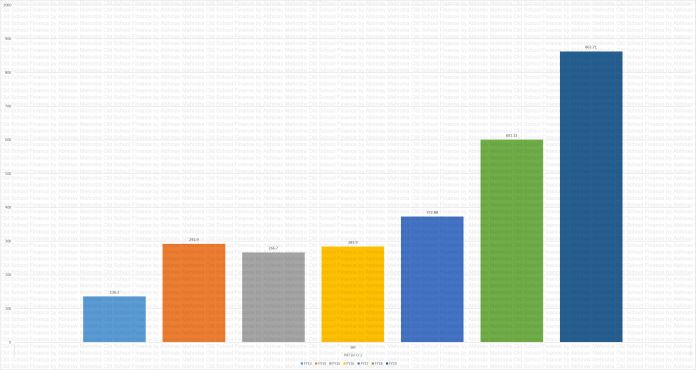

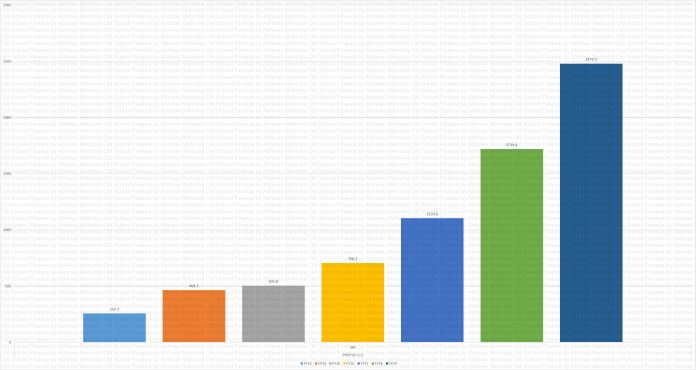

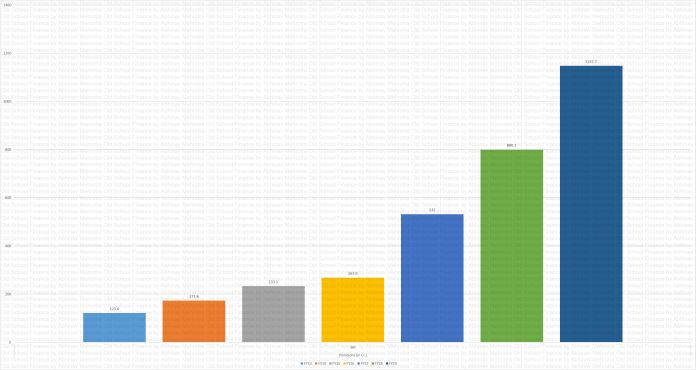

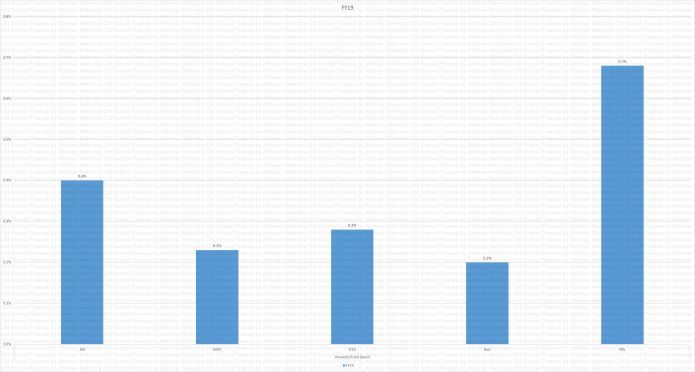

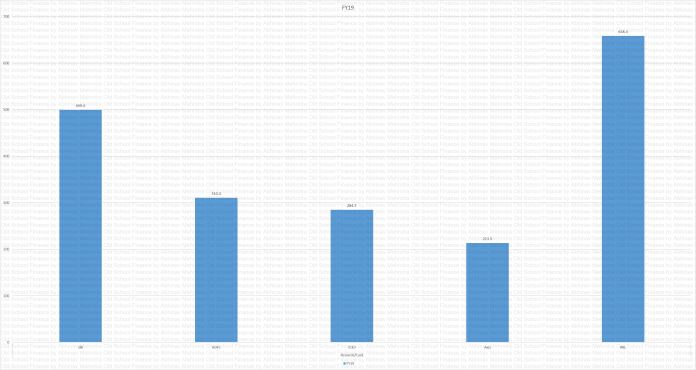

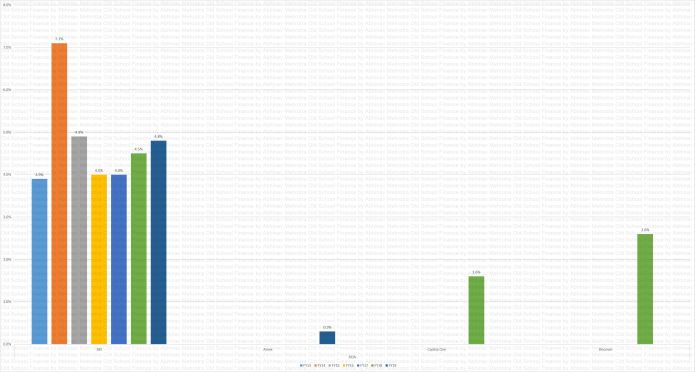

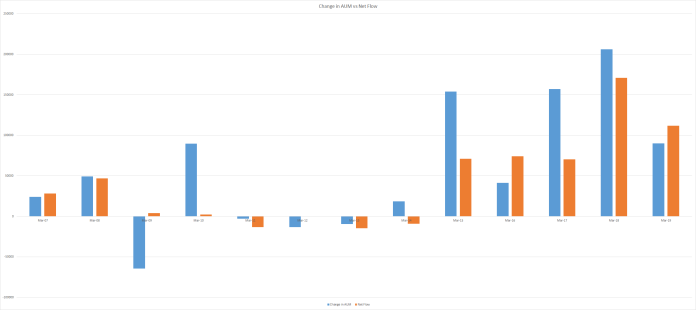

As we were walking the transition path, our business growth was maintained parallelly. We sustained a robust growth in our overall portfolio which grew by 18.4%. We focussed on Affordable Housing and Micro & Small Enterprise (MSE) growth this year apart from a stable growth in the Microfinance vertical. We ensured growth across all our branches pan India, thus minimising concentration risk of our portfolio.

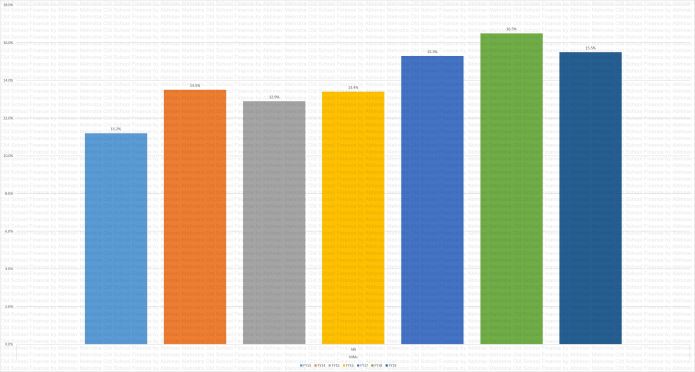

With a successful capital raise at the beginning of the year and better credit ratings, we were able to leverage and raise debt at lower costs, the benefits of which were passed to the customers through reduced interest rates during the year.

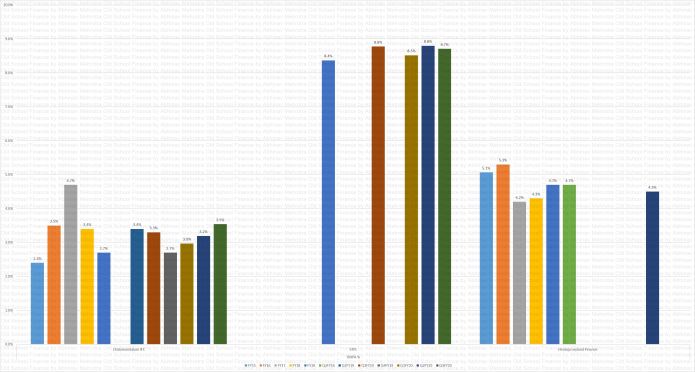

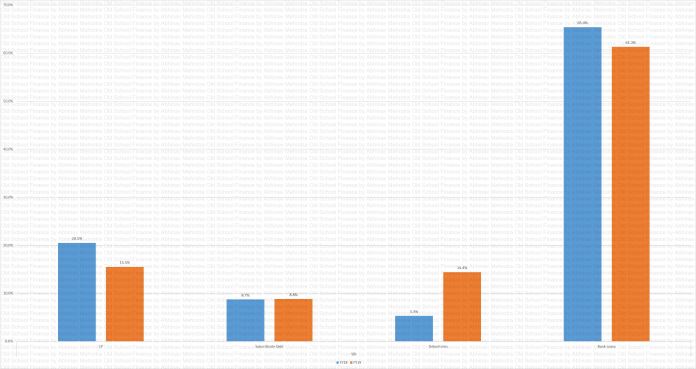

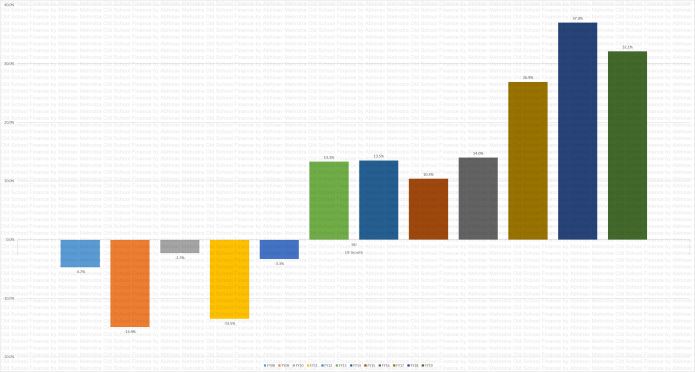

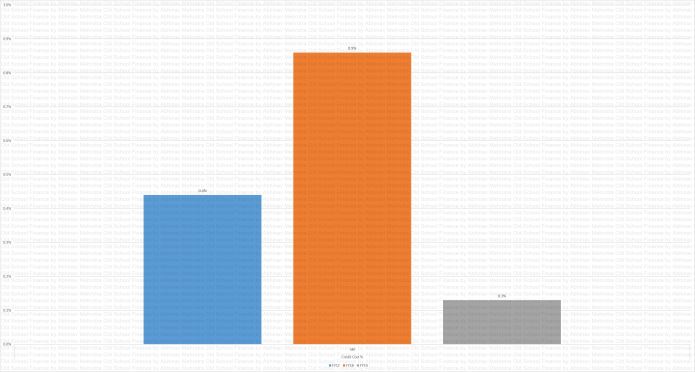

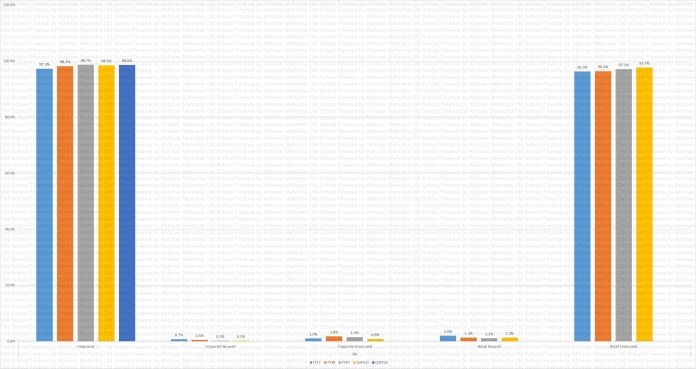

Demonetisation came as a critical challenge for the entire Microfinance Industry. So though the first half of the year closed with an excellent set of numbers, the impact of demonetisation was evident in the second half across key parameters including business growth, new customer acquisition, collection efficiencies and Portfolio at Risk. Tremendous efforts and initiatives by various teams enabled customer awareness and collections over the next few months albeit with a time lag. Post demonetisation RBI had also come out with a circular providing for an additional time of 60 days for recognition of loan accounts as sub standard. The GNPA without RBI dispensation stood at 3.7% and NNPA stood at 0.03%. The team across various functions continues with its collective effort towards coping with this challenging situation in the current fiscal year.

Customer Connect Initiatives

To hear and learn from customers about their needs and aspirations is always our first priority. This year, we conducted customer forum meetings across 4 regions at more than 400 branches month on month basis. We organized meetings and communicated about our products & services in order to expand the scope of services to our customers. These meetings gave us learning insights from customers and helped in modifying our approach and services accordingly.

Swagat Program

Swagat is the program launched to welcome Ujjivan’s existing borrowers to the fold of “Ujjivan Small Finance Bank through Opening of a Savings Bank Account for our existing borrowers which includes a personalized chip enabled debit card and a uniquely designed pouch made for customer convenience. Done with the help of a handheld device and an intention to enroll all our active borrowers before the launch of a branch, the campaign is completely paperless Aadhar enabled with biometric authentication

Insurance for Group Loans

Insurance for borrowers is available up to the age of 59 years and for their spouse up to 58 years. Availing insurance product through Ujjivan Financial Services is optional and is subject to sole discretion of customer/spouse.

Insurance for Individual Loans

· We advise all borrowers and co-borrowers to insure them

· Age of the customers must be between 18 and 57

· Premium amount: Rs.4.09 per 1000 loan per person per year

· Sum assured is equal to loan amount

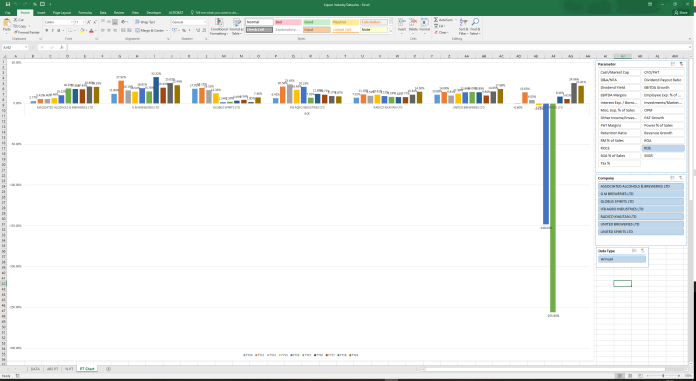

A lot of new loan products have been introduced this year. Refer to the excel sheet for more information.

Assessments:

Code of Conduct Assessment (COCA):

Ujjivan underwent the “Code of Conduct Compliance Assessment” during December 2016. The assessment was conducted by M2i Consulting, an independent agency, using COCA Compliance Assessment Tool. This tool requires scores to be assigned on the seven Code of Conduct dimensions – Client Origination, Loan Pricing, Loan Appraisal, Client Data Security, Staff Conduct, Client Relationship and Feedback and Integrating Social Values into Operations, across the four parameters – Approval, Documentation, Dissemination and Observance. The seven dimensions have been drawn from a review of the norms prescribed for MFIs including industry’s code of conduct, fair practices code of RBI and CGAP’s client protection principles (Smart Campaign). The COCA tool also specifically assesses the MFI for compliance against the RBI’s guidelines and scores it as well. The scores on the COCA indicators are then scaled down in proportion to the score received in Regulatory Compliance. Ujjivan has received composite COCA score of 93% (145.8 out of 157) on seven CoC dimensions and 100% (12 out of 12) scores on adherence to RBI directions which denotes “Excellent Adherence”.

Understanding the expectations of un-served and underserved customers from a bank

The unserved and underserved segment of the society generally perceives that the banking transactions are painful, unsafe, entail long waiting time in queues at bank branches and they also face lack of respectful treatment, difficulties in accessing their funds and poor assistance in filling forms or carrying out a transaction.

Due to these barriers, Ujjivan’s present customer base and large section of lower income group population don’t seek banking services for their day to day financial transactions. Ujjivan had assisted its customers to open savings accounts in other bank branches in the last few years. However, it was evident that these customers have not been actively using their bank accounts for the reasons mentioned above.

Therefore, our Service Quality programs focused on changing those perceptions towards banking, an assurance that ensures:

• Customers are treated respectfully irrespective of the size of their transactions

• Quick and hassle free services

• Doorstep services to ensure easy access and convenient banking

• Assisted services across channels for smooth banking transactions and ensure gradual shift from ‘assisted to self service’ model

Customer Relationship Management

Customer Care Representatives (CCR)

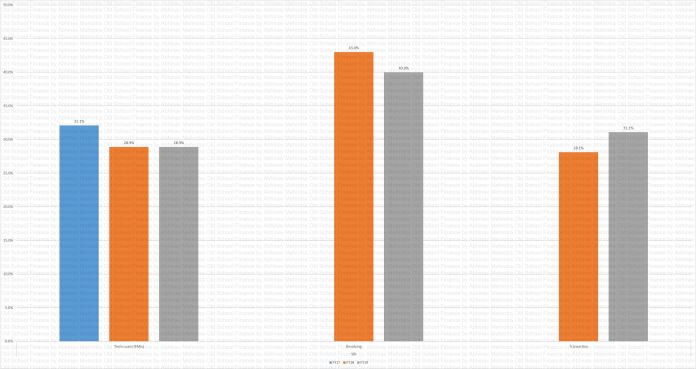

Enhancing skills from a Micro Finance role to a Bank Role: Over a period of 7 years we have developed a unique CCR program that provides abranch one representative who will focus on the needs of walk-in customers at the branch, their query and complaint resolution and on reducing customer dropout rates. One of the major achievements of the CCR project was achieving high customer retention rates through an exit interview process for dropout customers.

Preparing the existing CCRs for a Small Finance Bank was one of the key focus areas of Service Quality department during the year. The CCRs will now be placed at the welcome desk in ‘Bank Branches’ and specifically trained on attending customer needs and providing assistance in carrying out their transactions quickly. We have envisioned paper-less banking concept to make banking transactions effortless and quick. In case of any forms/ challans are still needed and customers are unsure of how to fill them, our CCRs and other staff at branches will assist them for the same. The training of CCRs are being completed through multiple phases including role based bank readiness training, technology and regulatory trainings. A variety of training methodologies are being used such as interactive sessions with group discussions, role plays using real life situations, practical technology sessions and e-learning projects.

CRM solution

Until now, a simple complaint tracker was used by Service Quality team to document, track and resolve customer enquiries and complaints. The complaint tool was not integrated with the core banking solution. Our new CRM software is capable of handling different types of customer support requirements such as service requests, deliverables management (debit cards, cheque books, statements of accounts), enquiry, complaints and feedback. The CRM solution enables auto assigning of service requests to concerned support functions and fulfillment teams, tracks resolution against prescribed turn-around-time and auto escalates pending requests. The system acknowledges receipt of requests or a complaint via text messages sent to customers and communicates the closure of the issues.

From a traditional Helpline to 24/7 Phone Banking Unit – multiple channels for customer support

We have migrated from a traditional 9 am – 5 pm helpdesk to 24/7 multilingual phone banking unit with an advanced contact centre technology. Our customers will not face hassles of IVR or robotic voice; their calls will be directly connected to dedicated officers based on preselected language preferences.

Risk Management

Ujjivan Financial services as a MFI had exposure to money market instruments through CPs in FY 2016-17 In addition to its traditional funding sources from Banks, NCDs and NBFC’s etc. As such the function of market risk was mainly restricted to ALM. Ujjivan had a unique process to evaluate and monitor risk at each of its branches. This included an assessment of both internal and external factors, including quality of credit portfolio, branch supervision, staff attrition and external events. A team of field risk staff complemented the efforts of the team at the corporate and regional offices to generate a risk score for the branches. Based on the risk scores generated, the branches that are deemed to be exposed to higher risks were subjected to greater monitoring and control and the frequency of audits at these branches was increased. It is this rigorous monitoring of risk at a granular level that had helped Ujjivan avert any major crisis that had affected the MFI sector from time to time.

In compliance with the requirement of Companies Act, 2013, Ujjivan completed in 2016-17, a review of its Internal Financial Control (IFC) based on the COSO framework. It is now in a state of preparedness for ISO 27001 certification and is implementing Business Continuity measures pursuant to the requirement of ISO 22301.

Our Culture

Ujjivan has a culture based on a set of core values of Integrity, Transparency, Respect, Professionalism and Teamwork tied together amidst diversity. We also practice an open door policy where employees are free to put across their ideas to foster transparency, fairness, integrity and innovation within the organization. Ujjivan believes in the purposeful involvement of employees at their workplace so that they can make a difference & give back to the community and make a positive impact.

Since inception, we have always believed in building a culture of trust in our processes & functions throughout the organization. As a result, we have grown together as an organization which is “Born of Trust” and are known for our service excellence. We have been able to achieve this by being a people-oriented organization.

Employee First

At Ujjivan, we believe in Employee Power & “Employees First” is our motto. We believe that happy employees create happy customers. Employees at Ujjivan feel cared for & valued. All employees here take a lot of pride in doing meaningful work & bettering lives. Ujjivan tops the chart in Customer Service & Customer Retention Ratios across the Banking & Financial Services Industry.

In this entire journey of transformation from microfinance to a Small Finance Bank we have ensured professional development is accorded the highest priority so that the employees feel valued and their skills are being nurtured to take over future roles within the organization. In alignment with the motto of ‘Employees First’, our Banking Services was first launched to our employees before it was opened up to our customers and the general public. While we transitioned into becoming a Bank, we always worked with the prerogative that new opportunities & roles will first be given to the existing employees before opening it up for external hiring & talent acquisition.

It is our constant endeavour to support our employees at all times of needs. One such momentous occasion came up as the country grappled with the aftermath of demonetization. With ATM’s unable to dispense cash and banks running out of money, we stepped in to support our employees and cash salary advances were extended to employees in addition to getting our partner banks to extend mobile ATM services to our staff in the offices. This well timed and well-meaning gesture helped our employees focus on supporting our customers well and focus on their work through the turbulent phase of the nation’s transformation.

MD&A

Business Growth

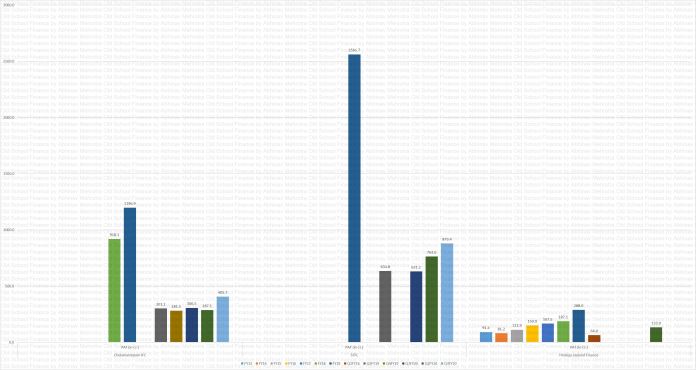

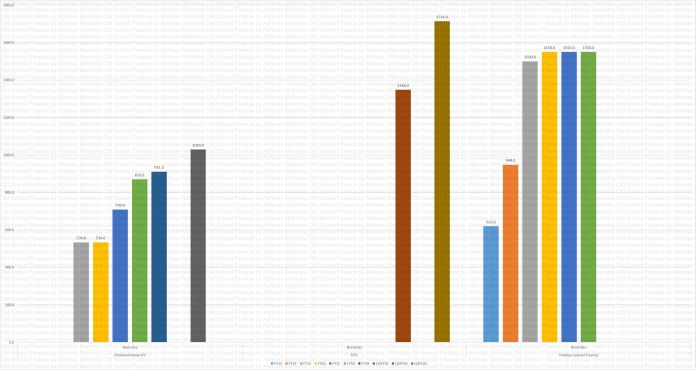

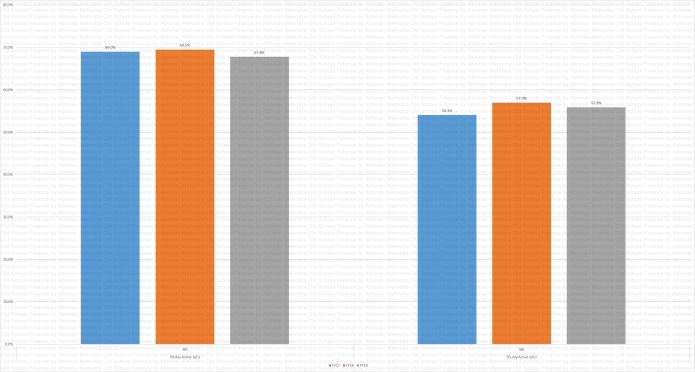

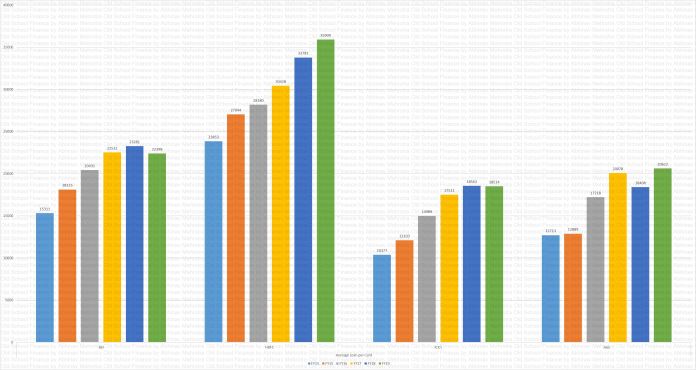

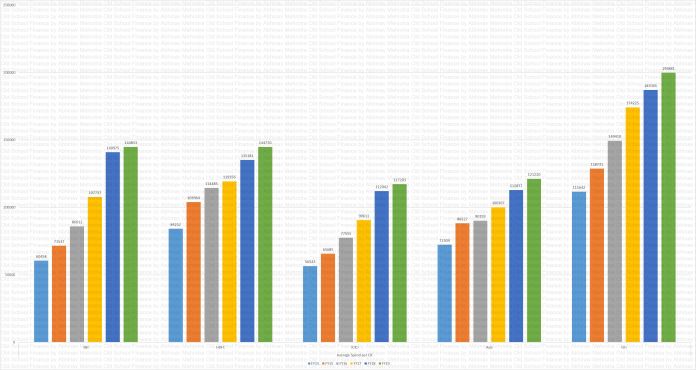

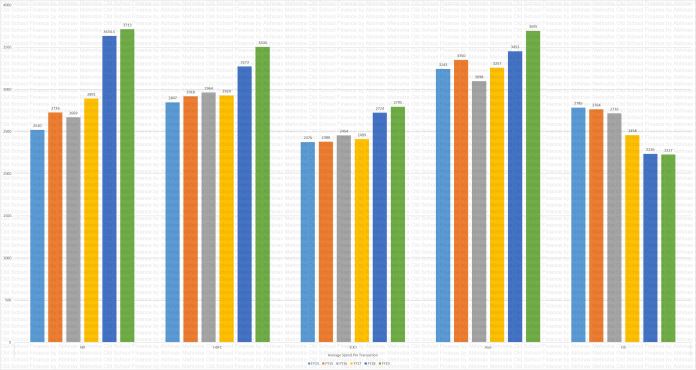

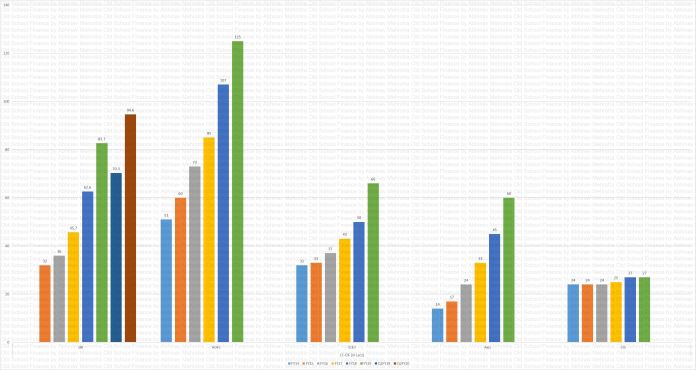

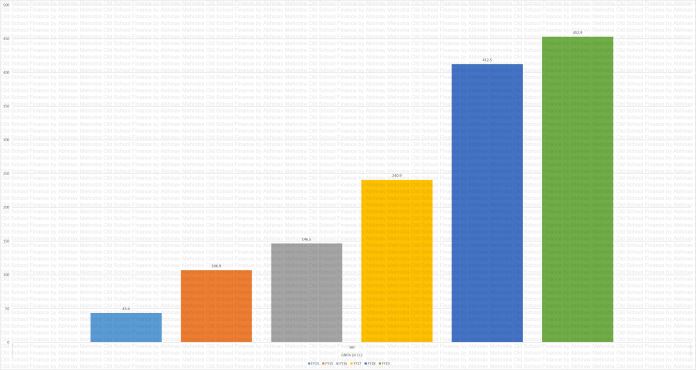

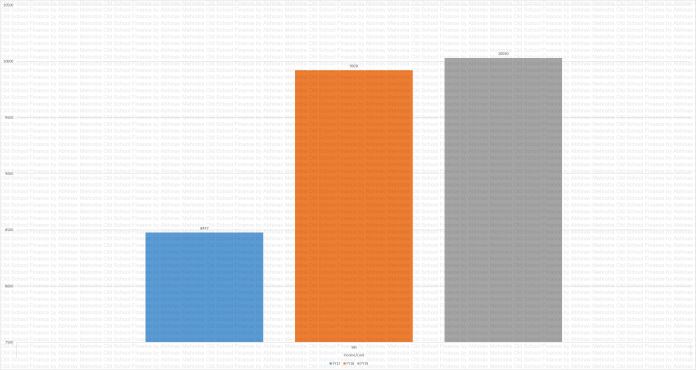

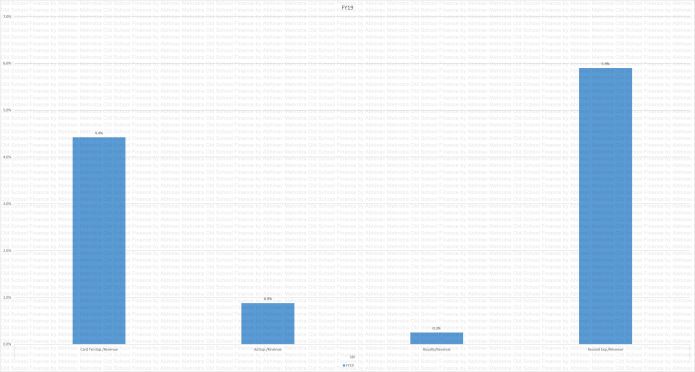

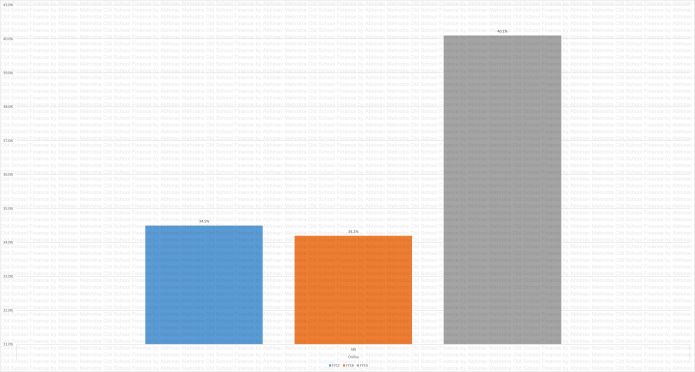

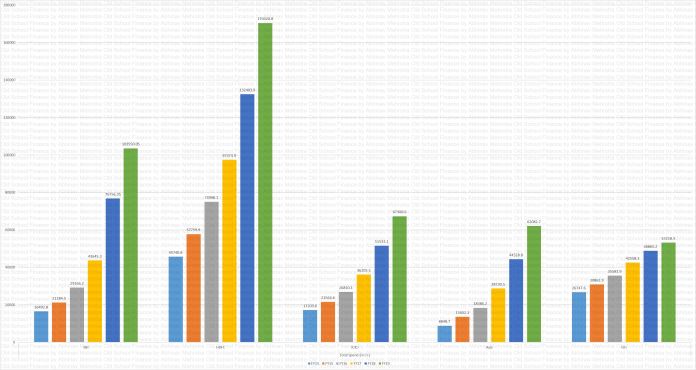

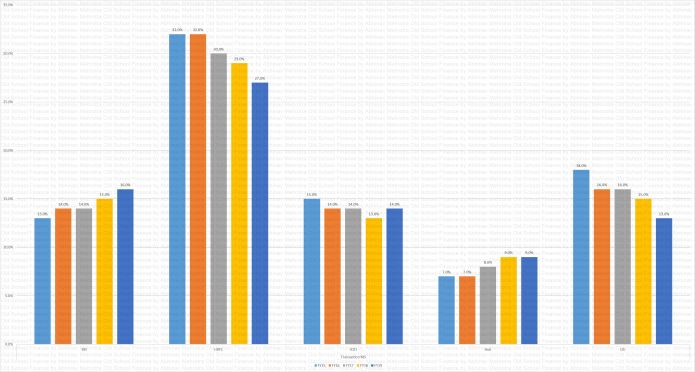

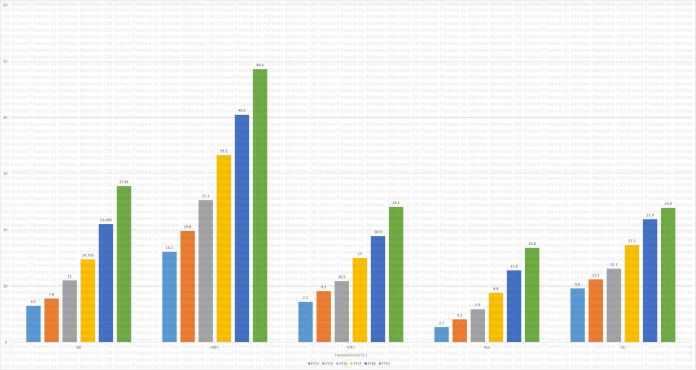

The strong growth momentum of the first half (59% growth in loan book over first half of PY) was impacted by demonetization which affected our business volumes and de-railed collection discipline, affecting our credit quality. Paucity of currency necessitated suspension of new customer acquisition for both group lending and individual lending business. We made cash disbursements to select repeat customers with good credit track record to smoothen their cash flows. In our first two months of operations as a Small Finance Bank, we garnered a deposit franchise of Rs.106.4 Crore including a retail franchise of Rs.6.6 Crore.

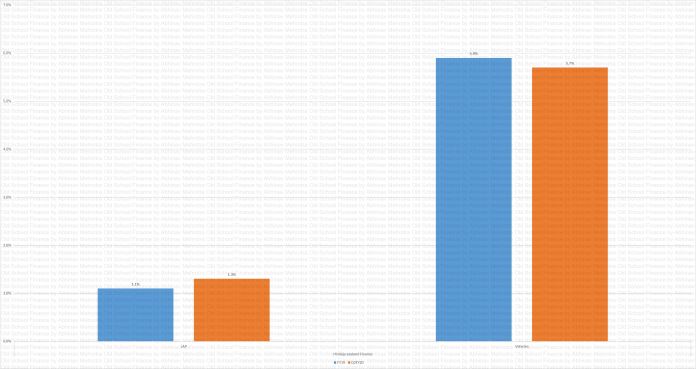

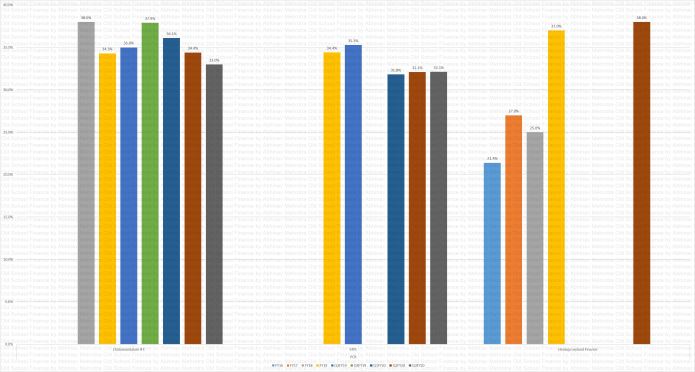

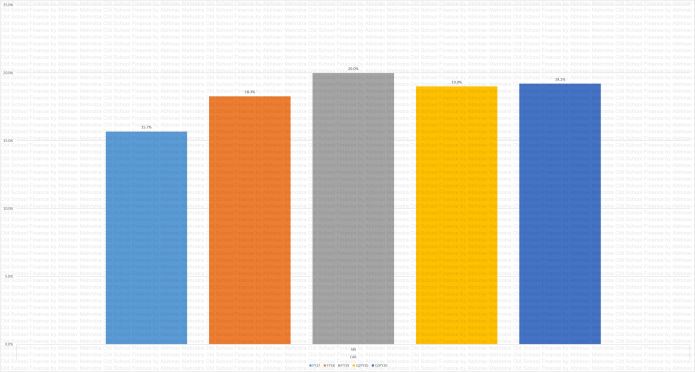

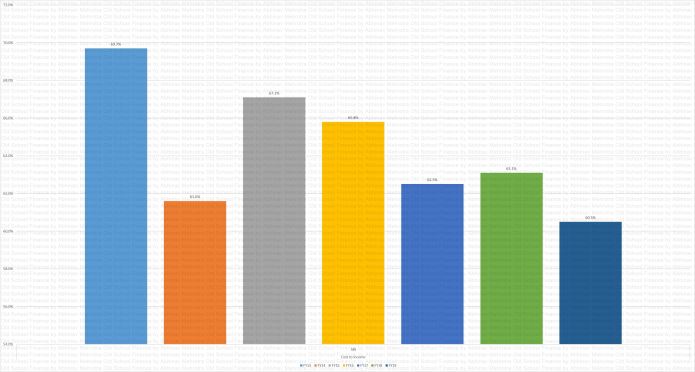

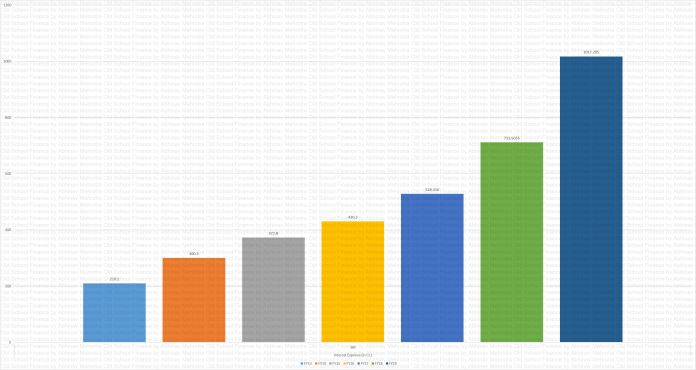

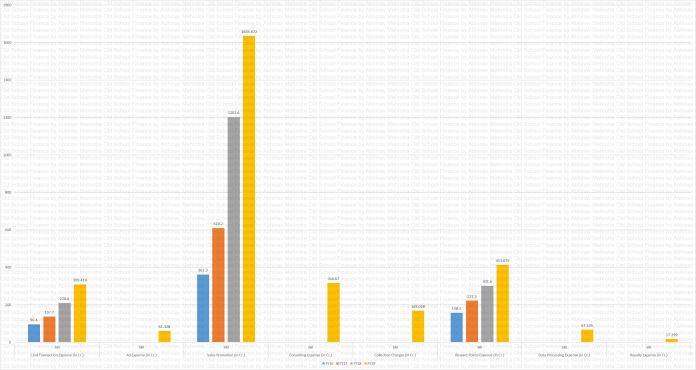

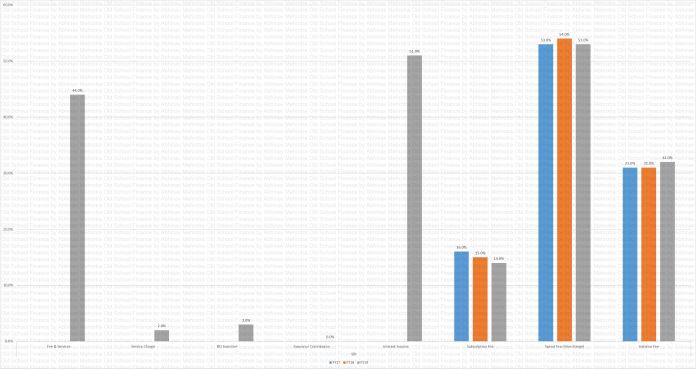

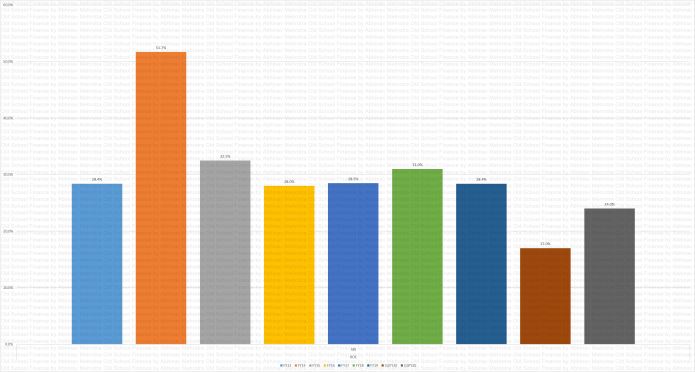

Funding

With increased capitalization levels on account of a successful IPO and better credit ratings, Ujjivan was able to raise funds at the most competitive rates. The average cost of debt and Marginal cost of debt saw a reduction by 1.6% and 1.4% respectively during the year, the benefits of which was passed on to our customers through reduced rates on our loan offerings. Interest rates on our GL and IL products were consequently reduced by 75 bps.

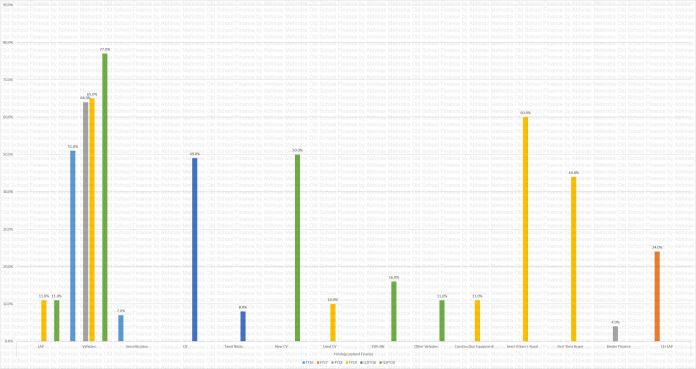

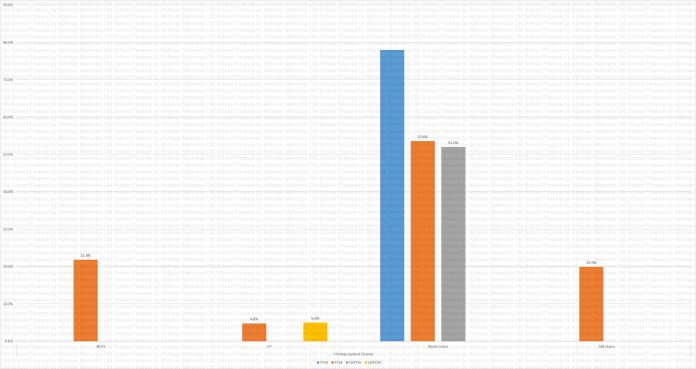

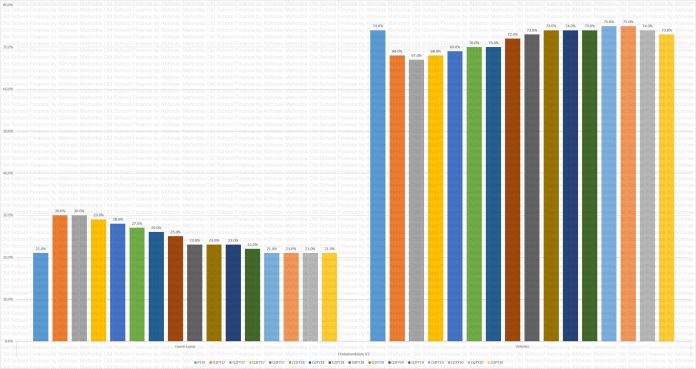

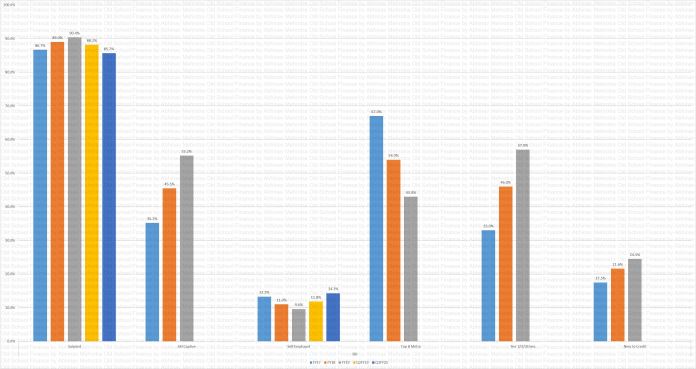

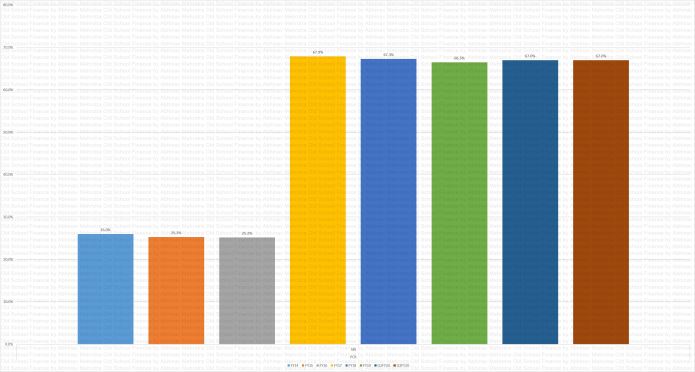

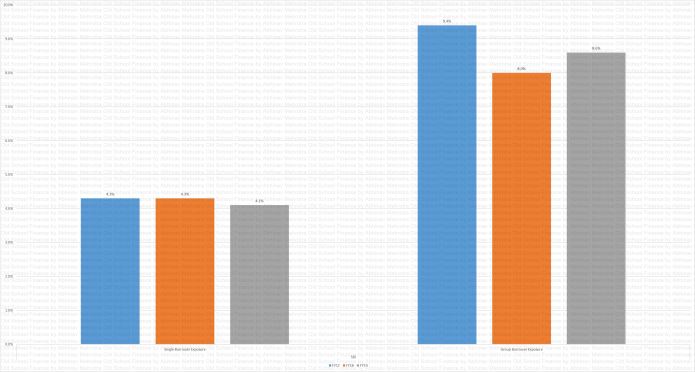

MF Business

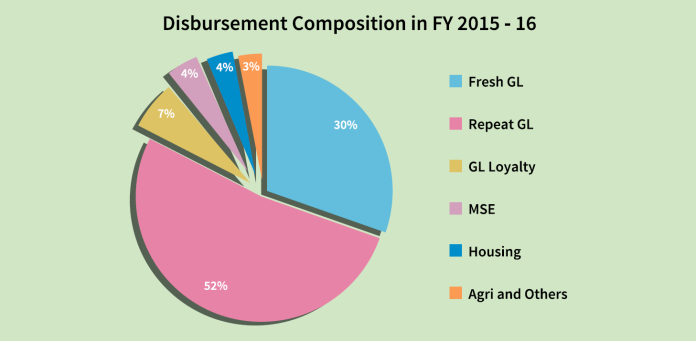

Loans to repeat customers constituted 71% of the business during the year while fresh business constituted 29%. New customer acquisition was expected to be moderate this year and lower than that in the PY primarily in view of focus on transition to banking. Fresh business had good traction up to the first half of this year with 10% growth over last year, slowing down in the next two quarters as demonetization affected our credit discipline and transition processes progressed in full steam. Fresh acquisitions was suspended during the demonetization period and significant support was offered to our customers during this time including disbursements in cash helping them smoothen their cash flows and we offered extended repayment timelines to enable them to acquire legal tender.

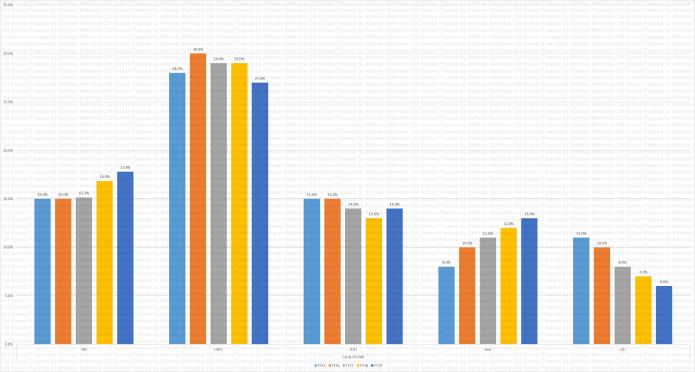

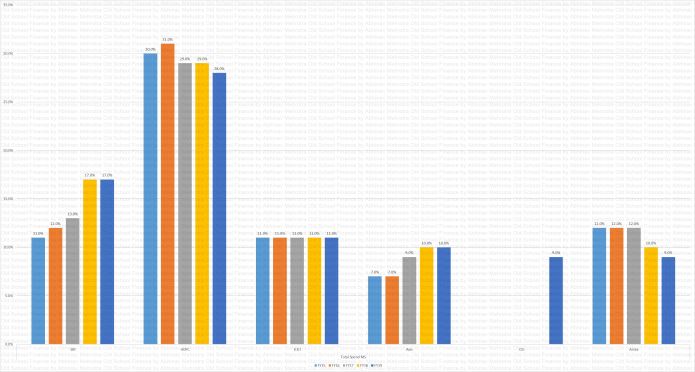

There was an increased focus on income generating loans during the year. 78% of the group loan book was for income generating purposes against 72% in the PY. Transition to an SFB has freed us from some of the regulatory restrictions on lending policies applicable to NBFC-MFIs. To ensure that customers are not over-leveraged on account of multiple institutions lending to them, we have retained the indebtedness cap at Rs.60,000 for branches with PAR >1% and raised the cap to Rs.100,000 for branches with PAR <1%.

Affordable Housing Business

The biggest challenge in the Affordable Housing space is the irregular or seasonal and largely undocumented income from informal sources. Ujjivan initiated its flexible “Assessed Income Program” to cater to customers in the informal segment in the semi urban and rural areas, assessing their income through minimal documentation – personal discussions, house visits and bringing them under the ambit of institutionalized lending. Our secured Housing business was affected due to a bearish real estate market as an aftermath of demonetization. Challenges in income flow and property valuation & construction due to uncertainty also affected volumes. Overall, the collections rate of the Housing vertical stood at 99%+.

MSE Business

The Unsecured MSE offering got good traction from our customers and contributed to 67% of the total MSE loan book. The Unsecured MSE offering got good traction from our customers and contributed to 67% of the total MSE loan book.

Paucity of currency necessitated reduction in business volumes. New customer acquisition for both group lending and individual lending business was suspended during the period and cash disbursements were made to select repeat customers with good credit track record to help smoothen their cash flows.

Risks

Major problems faced during the demonetization period were external interference influencing the borrowers against repaying and false complaints against field staff. Maharashtra, UP and Bengaluru faced overdue problems due to certain external forces trying to influence the customers and thus throwing a major challenge to the industry in particular. Vigilance team actively participated by way of meetings with local community leaders and government officials to thwart the negative influences. Concentrated efforts are underway to bring down the overdue numbers.

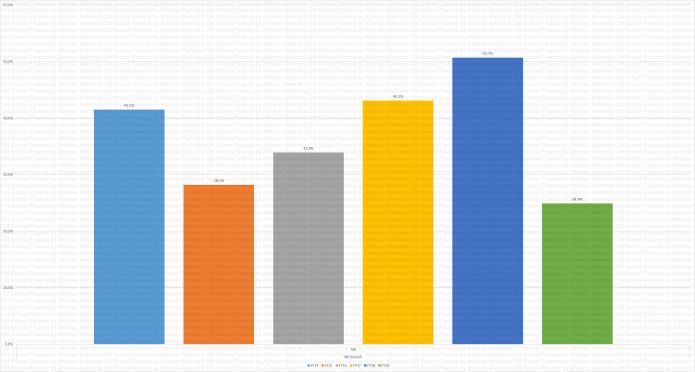

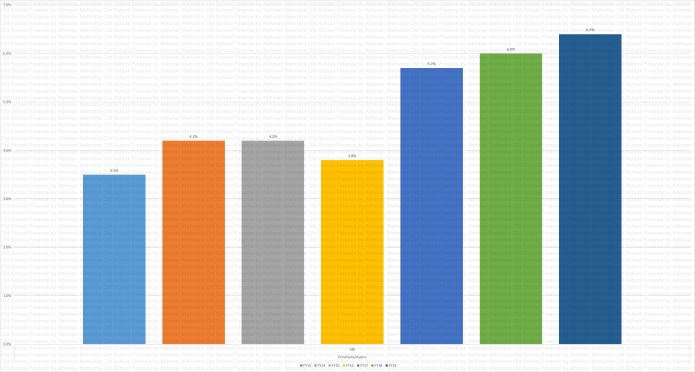

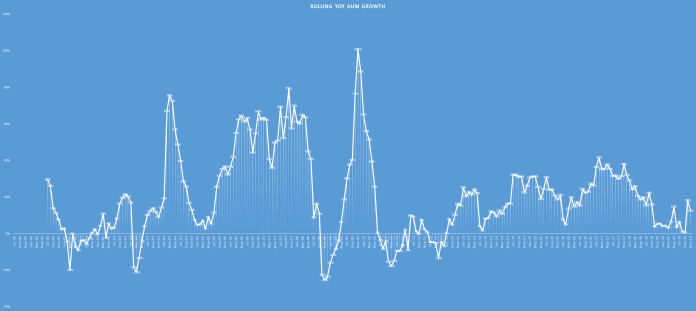

The first impact has been on the collections for the MFI Industry which dropped to 86% from its standard collection rate of around 99%. While banks were allowed to collect old notes, the NBFCs including NBFC-MFIs were not allowed to do so which led to higher level of defaults for NBFCs. Consequently the collection discipline was derailed resulting in higher PAR & Provisions during the year.

The RBI dispensation on classification of NPA (allowing a further 90 days over the 90 days overdue norm for classification as an NPA) was misconstrued and deemed as repayment holidays, adding woes to the already affected situation. This was further taken advantage of by local politicians in states of UP, Maharashtra, Uttarakhand and Karnataka. Our NPA levels saw an increase during the last two quarters due to local political interference and rumors of loan waiver disturbing the credit discipline among our customers affecting collections during the period.

Livelihoods of many of our customers across selective segments were impacted:

• The salaried segment received salaries in advance in old notes, their cash flows were badly impacted on account of this since these notes were not valid. Many factory employees lost their jobs.

• The micro and small enterprises faced a severe downturn in their business or were shut down on account of disruptions in the supply chain which is mostly cash driven. Income levels dropped all of a sudden which laid stress on their household cash flow management

• Similarly in Agriculture, the sales, transportation and distribution of agri produce to mandis/wholesale markets is dominantly cash driven and the cash crunch led to disruptions in supply chain impacting the sales volumes and increased wastage of perishables resulting in lower revenues and lower repayment capacity.

Since March 2017, there has been improvement in the customer’s ability to pay their installments, however, not all past due installments have been paid up. As a result, loan installments of such customers for the previous months are getting adjusted against the amount received. Due to this lag factor and until an account is normalized, there is a significant portfolio which will continue to be NPA during current financial year. Important point to note here is that the NPA is largely coming from states which have/are seeing errant political/ external interference misleading and forcing customers to default.

We offered extended repayment time for customers, continuing a healthy relationship with them during such testing times. Ujjivan pamphlets were distributed to all customers. We also ensured continued service to good customers by providing them with repeat loans. Loan rescheduling options have been provided selectively to borrowers in financial distress.

Customer Service

Quick and hassle free service with dignity, assisted services across service channels for seamless banking transactions, graduating to ‘self-service’ model are our mantra for customer service. Ujjivan is leveraging its IT infrastructure by using Aadhaar & NPCI’s range of services, E-KYC, E-Sign, AEPS, IMPS & Rupay to bring banking services to the underserved & unserved segment.

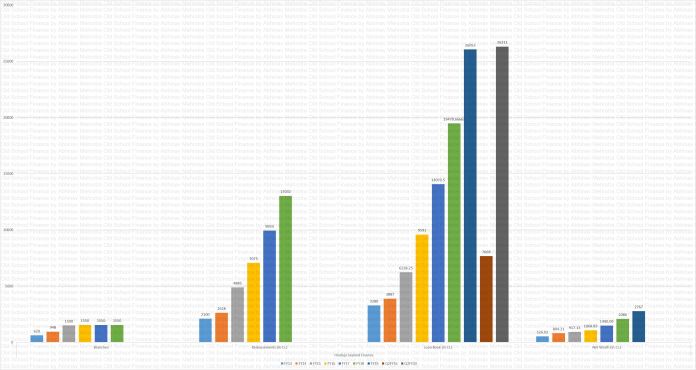

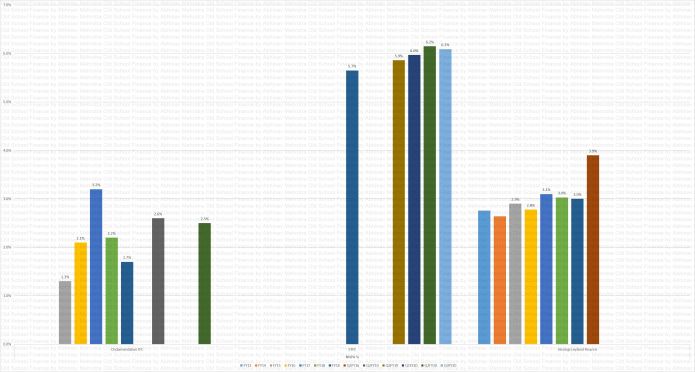

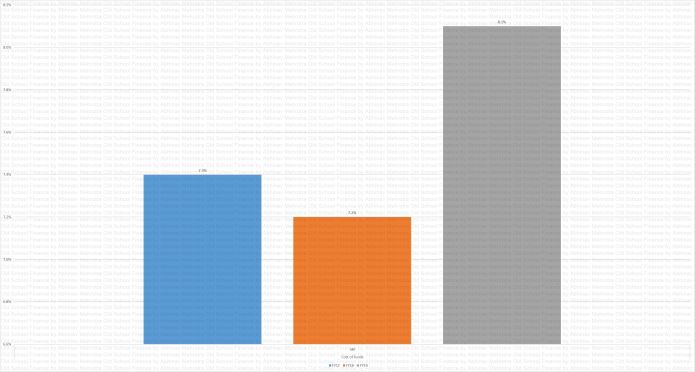

Provisions

Overdues falling in November’16 and December’16 were named as “Special Mention Accounts (SMA) – Demonetization” and classified as standard asset for 90 additional days (Up to 180 days) as per RBI dispensation. Provisioning was made at 10% (Group loans) and for Individual loans at 20% across SMA-Demonetization over dues for affected states with < 90% collection efficiency. Existing standard asset provisioning norms of 0.65% on GL and 0.75% on IL for 180 days were adopted across non-affected states with >90% collection efficiency on Nov’16 and Dec’16 Incremental Overdue accounts. Provisions were made on the monthly Incremental Overdues from Jan’17 onwards for the loan portfolio under the existing provision norms. No deviation from the existing policy. Cumulative Provisions as of March: Rs. 125 Crore on own assets.

Collateral Impact

Impact of Demonetization will spill over into the next financial year with increased credit costs. Ujjivan shall follow a cautious approach towards business in the stressed clusters to contain the credit quality for the first two quarters of the next year

Ujjivan Small Finance Bank

Letter from MD – Samit Ghosh

The danger pointed out by Professor Yunus is that if the same rules & regulations governing regular commercial banks are applied to Small Finance Banks (SFB), sooner or later these institutions will end up becoming banks in the same mould and SFB’s will lose out on the special purpose they are set up for i.e. Financial Inclusion. We are already seeing this unfold as we try and comply with a host of regulatory & compliance requirements. For example, the much awaited RBI’s new ‘Branch Authorization Scheme’ is a radical new direction of moving away from the traditional brick & mortar branches to the concept of ‘banking outlet’, yet it has to navigate through the path of the Banking Regulation Act. In order to succeed, it is imperative that the SFB’s and the regulators work together to craft a specialized set of rules & regulations, as it did in the past for NBFC-MFI institutions. He also added that Ujjivan Small Finance Bank is entering unchartered territory which will have its own set of challenges, but the organization needs to retain its culture, ethos and always reminisce that Ujjivan Small Finance Bank is a mission driven bank.

The five key challenges which are ahead of us this year are:

Portfolio Quality

Demonetization has possibly brought in significant benefits to the country in its battle against ‘black money’ and unaccounted wealth. However, for the entire microfinance industry where customers primarily operate in the unorganized sector and cash transactions are the main medium of exchange, it has been a major disruptor. The problem was exacerbated by local politicians who utilized this opportunity to raise the bogey of ‘loan waivers’ to give false promises to customers and destroy the financial discipline in a number of pockets. The redeeming feature is that unlike the Andhra Crisis, the RBI, State & Central Governments including local administration have largely been supportive of the microfinance institutions (MFI’s) and against loan waivers. The problem was initially complicated by allowing banks to collect repayments in demonetized notes in the first two months, but not permitting finance companies including MFI’s to do the same. Most customers could not understand this distinction and were confused. The poor portfolio quality was not impacted evenly across the country and surfaced in some major pockets. This could have been due to aggressive lending in the past two years by certain MFI’s in those areas. The impact was also felt in areas where livelihood was seriously impacted for micro-entrepreneurs and salaried individuals in the unorganized sector.

The MFI industry faced Portfolio at Risk (PAR) ranging from 5% – 20% compared to around 1% prior to demonetization. The RBI provided some relaxation in categorization of non-performing assets & provisioning for those assets which deteriorated during November & December. However, in the current financial year the industry will feel the full impact of the credit cost, which will be significant. Customers are slowly starting to repay the over dues but with a lag effect of 2-4 months and for some of the customers there has been a temporary impairment of livelihood. Further a section of customers who have turned delinquent are new to micro finance, being less than two years old in the system and hence less disciplined. A portion of these over dues is likely to be written-off but it is difficult to estimate at this moment.

In Ujjivan, we have categorized branches with high defaults as affected branches and at these branches the sole focus is on collection. We have seen a positive turnaround from March though the progress has been slow. We have put in place a number of collection programs to arrest the deterioration & start collection from higher buckets. Customers are also being re-assured that they would get repeat loans if they regularize the present loans. We are also taking measures of curtailing our exposure in locations where the credit discipline has totally broken down. Ujjivan is in the middle of the spectrum in terms of impact on the portfolio quality. We expect that it will take us few months to bring back the portfolio quality to normal.

Rolling Out Ujjivan Small Finance Bank Across the Country

We decided to roll out our branches in phases for a number of reasons. Our branches have been designed based on customer research and their needs. We also intended to have maximum impact of our new brand identity on the customers, which has been very well received. Despite all the preparation in our infrastructure, channels & technology, there are bound to be teething issues in the first six months.

The phased roll-out of branches is helping us gather operational learnings; we are able to access how do we improve our delivery skills and manage our costs. RBI’s long awaited ‘Branch Authorization Policy Guidelines’ was issued on May 18, 2017. This year we plan to convert around 150+ branches.

Building the Liability Business

One of the observations of Vijay Mahajan during the launch of the Bank was that generating liabilities by competing with existing banks was one the most challenging areas in his experience of managing the Local Area Bank for fourteen areas. Our initial plan is to focus on wholesale liabilities. In order to achieve this effectively, we need to get the ‘Scheduled Bank’ status. The RBI inspection has been completed and our expectation is that we should receive the Scheduled Bank status shortly. This will considerably ease the process of raising bulk deposits from institutions which will not only help us in

funding but will also lower the cost of funds.

Secondly, our focus is opening accounts of our existing microfinance customers and disbursing our loans into these accounts. This process is on and is being undertaken in a phased manner for customers of the SFB branches. Parallelly, the retail liability from open market customers has commenced. Our goal is to attract the underserved customers who keep their savings outside the banking system. This is totally uncharted territory and we are progressing slowly based on research and new offerings to specific customer segments.

Building the Asset Business and our Portfolio Growth

Post demonetization, our portfolio growth was impacted. We had restricted loan disbursals in affected branches. New customer acquisition was discontinued at these branches and only repeat loans to existing customers were permitted. However, the unaffected branches continued with business as usual. From March closer to pre-demonetization, we have seen overall disbursal of loans closer to pre-demonetization levels.

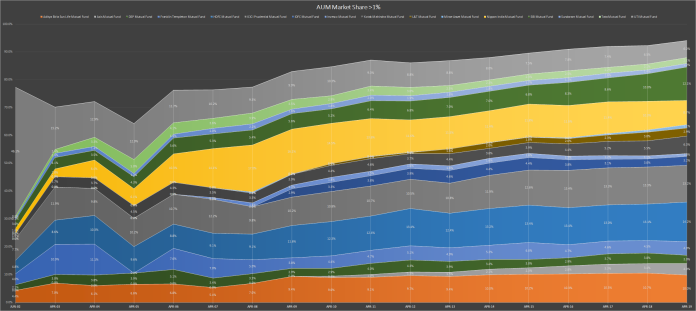

This year, our overall focus would be moderate growth in the microfinance portfolio and higher levels of growth in the micro and small enterprise business & affordable housing business; though these have currently very small bases. We are also exploring new loans products like personal loans to the underserved segments of customers.

We will also be looking at reviewing our microfinance business both in terms of process & products. This is for two reasons. Firstly, the impact of lower collections deteriorating our credit quality in a few pockets will require us to review and re-assess our existing processes in future. Secondly, we would be free from a number of restrictions as a SFB and we need to leverage this flexibility in our product offering.

Managing our Costs & Productivity

It was expected that our costs would increase significantly with our investments made in technology, channels, infrastructure, marketing, regulatory compliance and people in our transformation to an a Small Finance Bank. However there were unexpected impacts post November. of lower portfolio growth and lower collection efficiencies; therefore there is an additional impact of significant credit cost in terms of credit provisions and write-offs and higher operating expense ratios. All this requires us to bring in special focus on managing our costs & productivity. We will also take advantage of the three years given to us by RBI to convert all our branches to full service SFB branches. By the end of FY 2017-2018, we plan to have approximately 150+ Bank branches,. Our phased network expansion will be cost optimal and help us effectively apply our learning from our experience to the new and existing branches.

To conclude, this year is going to be extremely challenging. We are confident that we have requisite strategies & teams in place to overcome these challenges. Our profitability may be under constraints, But we will build a successful Small Finance Bank through this baptism of fire.

The long awaited RBI’s ‘Branch Authorization Policy Guidelines’ was issued on May 18th, 2017. This policy puts a lot of focus on Branchless Banking. The idea of Branch Banking has been replaced with a new concept called “Banking Outlet”. It acknowledges the power of technology and alternate channels like BCs etc to reach out to the unserved & underserved areas. Accordingly we have decided on a phased approach. We plan to open new branches in Unbanked Rural Centres to meet the regulatory requirement of having 25% branches in such locations. Our preliminary research and early experience suggests that such locations have significant banking business potential and the right business model for these branches will help us build robust business at such locations.

The new guidelines also gives us the benefit of considering our branches in the Left Wing Extreme Districts and North Eastern States plus Sikkim as our Unbanked Rural Centre branches. We have 19 of our existing branches in such locations, which will help us in optimizing Unbanked Rural Center branches in first year.

Technology Readiness

Technology is a key enabler for the viability of Small Finance Banks. As we plan to work with un-served & underserved segment of customers where nature of transactions will be high volume-low value,, we have developed a technology platform which leverages Ujjivan’s existing system and integrates with Aadhar & NPCI platforms and have invested in proven systems like Finacle, SaS, i-Exceed etc. We have tied up with Wipro as system integrator. Our data centre is outsourced to IBM to ensure maximum uptime and highest level of security. Our field processes are designed to provide doorstep & hassle free service, therefore mobility is the key to our technology. Handheld devices, paperless account opening and Biometric ATM are some of our key differentiator compared to the regular banks.

Looking Ahead

Looking ahead, as more branches go ‘Live’ with the full set of banking services, the Ujjivan experience will soon be available nationwide. In the next few months, 10 SFBs and 8 payment banks will join the banking industry. It will disrupt the industry and customers will have additional options to choose from. Each of these new entrant will have their own focus area and it will be quite interesting to see how the industry unfolds in the coming years. Given the size of unregulated shadow banking, there is a huge potential to bring those customers to regular banking system. As banking services reaches to unserved & underserved segments and area, we will see a lot of new customers entering banking system in true sense. Ujjivan is ready to reap the benefit of the changing banking industry.

It is important to acknowledge that each of our customer has their own expectations from a bank. To be successful, we must cater to the needs of our customers. Leveraging the technology stack and combining it with our significant on ground presence, Ujjivan can make a difference in the financial services industry. In the next 5 years we see ourselves as a leading mass market bank.

Brand Identity

The illustrative form is therefore a combination of two visual icons – a blooming flower and a bird set to take flight. The flower in bloom is a metaphor for welcoming (swagat, in our culture) and growth – as we welcome our existing loyal customers and future patrons into the banking fold. The bird symbolizes economic freedom and the aspiration to live your dreams, free from any discrimination financial or otherwise. When combined, it beautifully represents a powerful human centric brand identity that celebrates Ujjivan’s deep rooted societal connect and continual impact on building better lives for the millions of our customers.

SFB Products

Liabilities: Four savings, two current account variants along with two Term Deposit products were designed.

Savings Account Products: There is no entry barrier for the Savings Account i.e. there is no requirement for maintenance of minimum balance along with a host of facilities provided like Aadhaar enabled KYC using biometric authentication for paperless account opening, Rupay debit card and transactions at multiple access points like the Branch, Bank Meetings, ATMs, Mobile Banking, Internet Banking and Phone Banking. One regular and another for minors, two BSBDA accounts with 1 year validity for those without KYC documentation.

Current Accounts: 1000 rs. initial deposit, one with 5000 rs AMB and another with 10000 rs.

Deposits: Fixed Deposits and Recurring Deposits start with as low Rs. 1000 and Rs. 100 respectively with a premature and partial withdrawal facility without penalties to give the customers higher liquidity options. Option to opt for interest payment at monthly, quarterly, half-yearly or yearly frequency, Can be opened through Internet and Mobile banking, No penalty if deposit is fully or partially closed after 6 months.

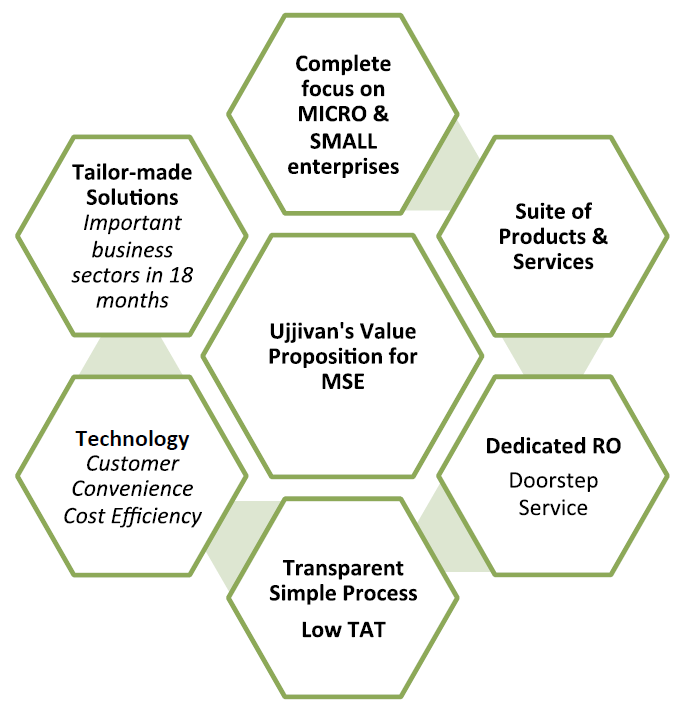

MSE

MSEs face a lot of issues in accessing institutional finance and continue to be dependent on sources such as moneylenders, pawn brokers, chits/committees apart from family and friends. It has been acknowledged that lack of institutional finance has stunted the growth of MSE for decades. Therefore, the Reserve Bank of India has mandated the aspirants of Small Finance Bank to focus on MSE as one of the main customer segments.

Additionally, Government of India has set up a dedicated refinancing agency MUDRA (Micro Units Development and Refinance Agency Limited) to facilitate flow of funds to this segment of customers. The unmet financial needs of MSEs offer a great opportunity for banks and NBFCs to develop a strong business line dedicated to this particular sector. However, the banks have not been able to do much due to various structural issues and NBFCs have not been able to provide a complete product suite, apart from term loans. Ujjivan has recognized MSE as its main target segment in line with its mission and also for product diversification and future growth. As a part of MSE Business, since August 2016, we have launched 4 new products across 40+ branches and through these, Ujjivan Financial Services has financed over 2200+ micro and small enterprises and disbursed approximately 56 Crore since the program was launched. This was achieved by inducting new customers from the open market. Since inception, the primary focus has been on open market sourcing.

The Way Forward: A dedicated MSE finance unit has been set up to cater to the needs of the segment. The unit will understand the needs of the customers, the business environment including competition and the risks and mitigations in order to bring out products and services for the micro and small enterprises. The products and services are being kept simple with high technology support in order to ensure fast delivery, quality underwriting and superior customer experience while maintaining efficiency.

The following products will be on offer in the course of current financial year:

• Secured Overdraft

Additionally, the facilities of Current Account, Remittance and Payments, Insurance, Savings and Investment will be offered to both our existing and potential customers. The use of technology will be instrumental in delivering superior customer experience by bringing efficiency in origination and management of loans. Further, technology will increase the reach and profitability of the MSE business vertical by making available reports and MIS. Better customer segmentation, predictive analysis to facilitate target marketing; and credit decision as well as portfolio management will also become possible. MSE Finance will be Ujjivan’s growth engine during the current year and also in the years to come.

Liability Sourcing

In the retail space, the focus is on mass market with specific attention to unserved and the underserved. Products have been designed in such a way that they are simple to understand and are delivered in a user friendly manner leveraging state of the art technology.

Few highlights of our offerings on the deposits side are

1. Use of handheld device to open accounts at customer’s doorstep and at the same time reducing the account opening TAT drastically

2. Implementation of CRM solution to give customer a seamless and unified experience across channels at every, starting from acquisition

3. Product design that addresses key concerns of customers

4. Non IVR call center to give customers a personal & human touch

5. Branch design philosophy flows from the aspirations and at the same time addresses the apprehensions of the target customer segments.

All our existing loan customers are being on boarded into the liabilities banking relationship through an integrated program involving financial literacy, assisted banking and account opening through a simplified process. New customers will be acquired through a specialized team operating out of the bank branches. The approach involves identifying customer sub-segments through catchment mapping. This is used as an input for designing and implementing communication to reach out to each sub-segment. Use of Customer Relationship Management Solution enables tracking of each lead till fulfillment stage .Hand held device in an Aadhaar enabled environment results in customer account being activated in a fraction of time compared to what it would have been otherwise.

A large segment in the liabilities space is the institutions. This covers large government, semi-government and non-government entities. This space in terms of deposits size and potential in the universe of deposits is as large as the retail space. The approach here is completely different from that in the retail space. Customer connect and servicing for institutional customers is managed by a small team of

specialized and trained relationship managers. Institutional business is the source of large deposits which allows us to focus on building pure retail franchise in a systematic manner.

The focus is on identification of institutions and work closely with decision makers to get the bank empaneled, so that we can participate in the deposits requirement of the institutions in a mutually beneficial manner. Relationship managers are mapped to institutions to ensure continuity and build ability to spot opportunities to deepen the relationship. Within the institutional space, the specialized set of financial institutions including banks, insurance companies, mutual funds and others is serviced by FIG (Financial Institutions Groups) team which is part of treasury.

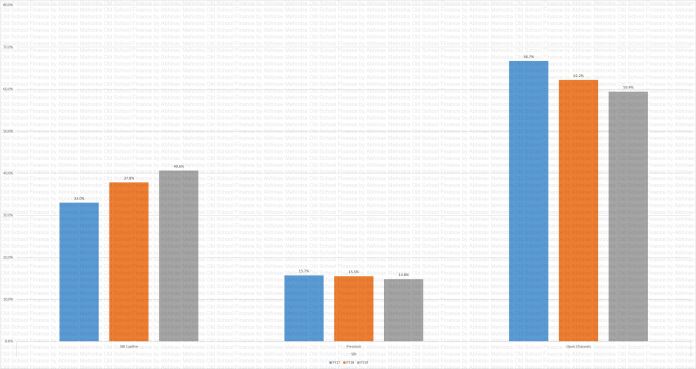

Channels

Channels is one of the start-up units that was set up in preparation for transition to a Small Finance Bank. These channels are intended to change the way the un-served and the under-served accessed banking services, build the basic banking habits to facilitate financial inclusion and to reduce costs as the business scales. The goal is to integrate people and technology to deliver unique segment specific solutions. These solutions delivered, will demystify banking and provide convenience through a continuum of options ensuring customers work their way up in the value chain. Customers expected doorstep banking which was communicated to us; consequently we set out to find solutions and the evolution from ‘assisted to self-service’ was the mantra to create value for all.

Today we deliver services through strategically launched multi-channel networks. This mix which includes branches, hand held devices delivering doorstep services, ATMs, debit cards, internet banking, mobile banking and phone banking has converted the Micro Finance delivery framework to full service bank delivery capability We also operate an in house phone banking unit which caters to service level queries. Our customers will not face hassles of IVR or robotic voice; their calls will be directly connected to dedicated officers based on preselected language preferences.

We are continuously improving and evolving our direct banking channels (branch and hand held devices) to enrich the digital banking experience for customers and enable them to make an easy and gradual shift from the assisted mode to the self-service mode. With this infrastructure in place, we facilitate product sales through these alternative channels. These innovative delivery channels are the key to a more efficient payment system and supported by a focused financial literacy drive for customers these options are transformative in nature. We have moved closer to offering financial services “anytime, anywhere” for the segments we serve.

The industry holds immense potential and the success strategy lies in our solution architecture being adaptable, scalable, secure and easily accessible for our customers who will become more financially astute in their banking habits.

MD&A

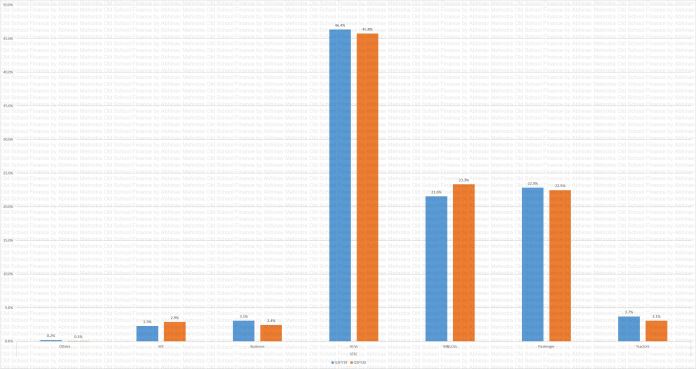

The regulatory norms mandate a focus on small ticket lending in the financially excluded segments by necessitating loans below Rs.25 Lakh to form at least 50% of the overall loan book. While products offered would vary, the focus customer segment of the SFB operating model would be the economically active urban and rural poor and small self-employed customers.

The government has taken several initiatives to boost the growth of Affordable Housing segment, including the ‘Housing for All by 2022’ scheme and the Interest Subsidy Scheme under the Pradhan Mantri Awas Yojana (PMAY). The MSE segment has also received a major stimulus through the Pradhan Mantri MUDRA Yojana.

Asset base diversification to individual MSE and affordable housing loans would expand the business potential in these segments and balance growth across various segments for the microfinance industry thus making the business model more robust.

Scaling up our deposit business will be a major focus area for this year. We shall follow a three pronged strategy for building our liability business. The first priority shall be sourcing higher ticket institutional/corporate deposits to rapidly scale up our deposit franchise and repay our high cost grandfathered loans, reducing overall cost of funds. The second priority is garnering deposits from our existing customers by offering them a bouquet of liability products. Our third focus will be on open market customers especially the un-served and the underserved who are essentially outside the formal banking system. Our products design is simple and easy to understand thereby enabling active participation by customers in these segments in the use of banking services. Paperless account opening, Biometric ATMs and access of bank account in center meeting using handheld devices are some of our key offerings, leveraging technology for faster delivery.

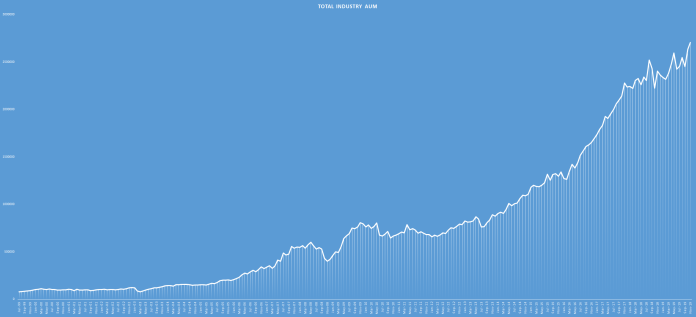

SFB – The Way Forward

The Small Finance Banks will be formidable incumbents, each with 5-10 years of track record of running viable and successful enterprises. Together they have combined loan book size exceeding Rs. 25,000 Crore and serve over 11 million customers across the country. The onboarding of these institutions into specialized banking will augur well for financial inclusion in the un-banked and under-served segments. The advent of fintech has caused a major disruption with technological innovations benefitting the customer ecosystem with new payment technologies, including multi-channel payment solutions, lower processing costs, lower turnaround times. The SFBs will have to leverage technological innovation in tandem with their wide outreach for efficient delivery to the last mile. Ujjivan has already set out on its mission to be the best institution to provide financial services to the un-served and underserved customers and transform to a bank serving the mass market.

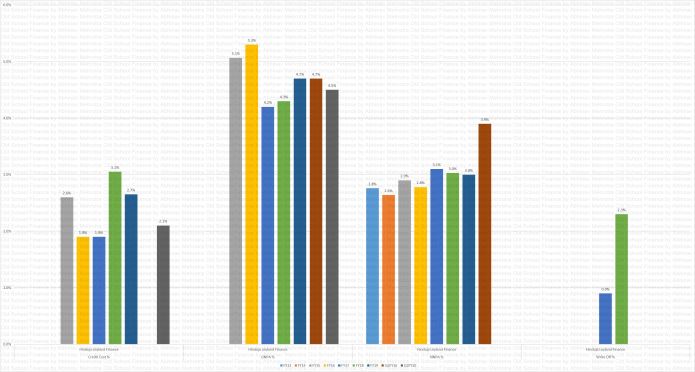

In terms of the operating guidelines issued by the Reserve Bank of India (RBI) for Small Finance Banks (SFBs), all SFBs are required to follow the Basel II Standardized Approach for Credit Risk. Guidelines with regard to capital charge by SFBs for Operations Risk and Market Risk are awaited from RBI. As per the capital adequacy framework, SFBs are required to maintain a minimum capital adequacy of 15 per cent of their Risk Weighted Assets (RWA). USFB has, in computing its capital adequacy, applied the more stringent principles applicable to Basel III and as stipulated by RBI in its Master Circular RBI/2015-16/58 DBR.No.BP.BC.1/21.06.201/2015-16 dated 1st July 2015. However, for its mandatory disclosures in the Balance Sheet as at 31.3.2017, the Bank has provided for capital computation under both Basel II and Basel III.

Based on RBI guidelines on capital adequacy, the CRAR of the Bank as on March 31, 2017 using the Basel III principles and including capital charge for both Operational Risk and Market Risk was 18.24% against the minimum regulatory requirement of 15%. When the RBI guidelines applicable to Basel II framework are applied, the Bank had a capital adequacy of 19.53%.The Bank is therefore well capitalised.

Credit Risk Management

The Unsecured Credit function specifically manages and monitors the microfinance business (JLG) and Individual Loans through an independent loan underwriting and approval process. Credit risk monitoring for the unsecured lending portfolio is undertaken in the following way:

• Field credit teams ensure implementation of various policies and processes through random customer visits and assessment, training of branch staff on application errors, liaison with other institutions to obtain necessary information/loan closure documents, as the case may be, and highlight early warning signals and industry developments enabling pro-active field risk management. The efforts of the field credit team are supplemented by that of the strong Internal Audit framework of the Bank. This is primarily audit of field and branch banking processes, including the credit sanction and disbursement process. Any breach is highlighted and corrective measures initiated;

• Branch specific credit limits for JLG business have been formulated that define credit limits for various occupations thereby addressing exposure and concentration risks. The limits so drawn ensure approvals in accordance with customer’s maturity in the lending system, vintage with USFB, primary occupation of the family and their locale. The entire policy suite thus enables robust customer selection and assessment;

• Portfolio analysis and reporting is used to identify and manage credit quality and concentration risks. Monthly branch credit performance score cards have been implemented to ascertain the health of the branch portfolio. These score cards capture critical portfolio quality parameters such as loan application error rates, arrears, collections and write offs. The lending limits for branches are adjusted based on these scores.

Credit risk monitoring for the Bank for MSE and the affordable housing sector is broadly done at two levels – account level and portfolio level. Account monitoring aims to identify weak accounts at an incipient stage to facilitate corrective action. Portfolio monitoring aims towards managing risk concentration in the portfolio as well as identifying stress in certain occupations, markets and states.

The Bank has also established an Early Warning System (EWS) to identify and act on signs of early sickness in the loan accounts and take necessary corrective action. Such accounts, where potential distress has been identified, are included and maintained in a watch list and reviewed on a periodic basis by the business and underwriting units so that suitable steps can be taken for mitigation of risk. The Bank also actively monitors its credit portfolio on non-stress related factors, such as concentration risk and program limits.

Special Mention Accounts

A system of early recognition with timely and adequate intervention forms the focus of the approach in dealing with slippage of NPAs. In this context, the RBI has suggested introduction of an asset category between ‘standard’ and ‘sub-standard’ for internal monitoring and follow up. This asset category is known as ‘Special Mention Accounts (SMA). The SMA has potential weakness and hence deserves close management attention which can be resolved through timely remedial action. If left uncorrected, the potential weaknesses in the said asset may result in deterioration in the asset classification.

In conformity with the prudential norms of the RBI, and its Board approved policy, the Bank makes provisions on its Special Mention Accounts. The provisioning norms are applied on a time bucket basis. Time bucket is determined from the date the account becomes overdue.

Classification of Non-Performing Assets (NPA) and Provisions on Loans

The Bank classifies its advances into performing and non-performing asset in accordance with the extant RBI guidelines and its Board approved policies. The Bank makes general provisions on all standard advances based on the rates approved by its Board. The provision on standard asset is not reckoned with for arriving at net NPAs and is not netted off from gross advance. Specific loan loss provisions in respect of non-performing advances are made based on management’s assessment of the microfinance business (JLG), Individual loans and MSE and the affordable housing sector subject to the minimum provisioning level prescribed by the RBI.

Credit Risk Mitigation- Disclosures for Standardized Approaches

Credit function has a certification process for all business and credit staff involved in the field level customer assessment for all its asset products. This training is also used to delegate role based credit approval authority to the credit team at regional and central level. A well-defined approval and deviation matrix authorizes personnel in the hierarchy to approve loans categorized on various risk elements.

The JLG and Individual Loan portfolio of the Bank is unsecured. Loans to the affordable housing segment are collateralized by a mortgage over the property financed. The Bank is in the process of developing a score card model which would facilitate operational decision making. There is a Credit Approval committee comprising senior officials of the Bank which sanctions only the credit proposals above Rs 20 lakh.

Credit Risk Mitigant

Credit risk mitigation refers to the use of methods to reduce the risk of lending to a borrower. The Bank has put in place a detailed credit appraisal process which is captured in separate product manuals and product programs. The mitigants used in the unsecured lending portfolio are as follows:

• Life insurance is mandatory for all the borrowers in the JLG segment.

• Bank works with 4 credit bureaus and ensures 100% application screening through the bureaus. State of the art paperless approval process, through the document management system enables a quick and uniform approval process.

• Customers with emerging credit problems are identified at an early stage through the tele-calling team and classified accordingly. Remedial actions are implemented promptly to minimize the potential loss to the company.

• A robust process for end use monitoring of funds post disbursement.

• An effective use of the centre meeting platform for its JLG portfolio to determine incipient problems and introduce risk mitigants as appropriate.

The Bank currently holds physical collateral for credit risk mitigation purposes for its affordable housing portfolio, but has no holdings in eligible financial collateral. Hence no allowance for eligible collateral has been made in the computation of capital charge

Management expects the interest rate impact to be +-12.6851 cr to earnings in case of +-200 bps move in interest rates respectively. Similarly it expects a +-27.0727 cr impact to economic value in case of +-200 bps move in interest rates respectively.