Image Link – https://drive.google.com/file/d/1lrEJR94p606xxcwRPOtf0SSDYNWNJN0k/view?usp=sharing

Introduction

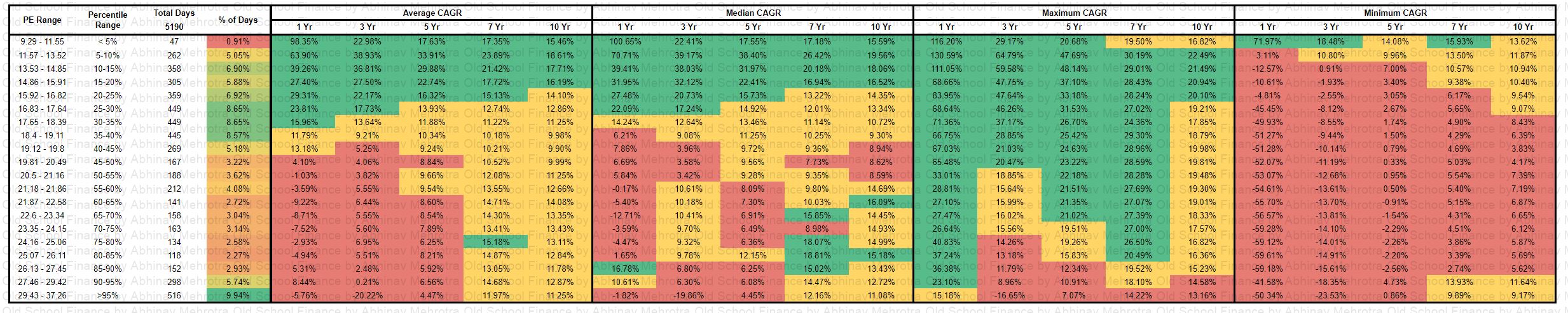

With the disappearance of alpha in large cap active mutual funds, midcap, smallcap and index investing is becoming more popular everyday with the masses, and factor based investing is gaining traction amongst the more savvy investors, thus this is a good time to understand what has happened and is going on the Indian indices space.

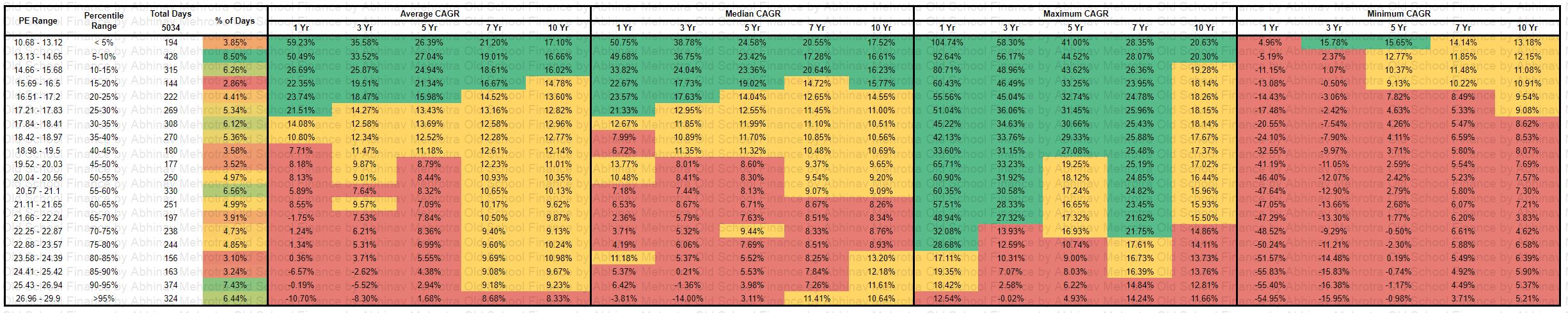

In the image linked above, I have summarized all the data points in one place. I have calculated the probabilities of earning greater than 12+% CAGR over rolling periods of 3/5/7/10 years. This exercise has been done for the 11 most popular indices for which various ETFs and index funds are available or coming up soon. We could not find long enough time series data for the smallcap indices to draw meaningful conclusions and thus have skipped them.

How are the probabilities calculated?

The probabilities are calculated by dividing the rolling periods which show greater than 12% CAGR by the total rolling periods in the relevant time frame.

Time Series Selection

I have used datasets from two different time series, one is from the inception of the various indices and one is from start of the year 2010. This has been done because market behaviour, and returns evolve as the tools the participants use evolve and as more participants enter the market. This made it necessary to look at more recent data of the last decade and remove the extreme market movements that happened during the older market regimes of the two decades before it. Such extreme movements are less likely to repeat as the markets are fundamentally very different now.

Return Threshold

I chose 12% as the threshold for returns because it is neither too aggressive nor too conservative in terms of return expectations from equity asset class. If you wish to change this assumption, I have linked the google sheet below which you can use to do the same probability calculations for different return expectations. The sheet is only limited by the data availability of Google Finance.

Time Periods

I chose to start with 3 years rather than 1 year because I believe 3 years is the minimum timeframe one should be invested for in the equity asset class. 1 year average return data has been included to provide a full picture of returns. One should compare these with the maximum and minimum return possible in 1 year to understand the risk associated with equity as an asset class.

Probability Classification

In terms of probabilities, I believe anything above 75% are good odds and thus have been highlighted in green. Probabilities between 50% and 75% are in yellow and below 50% are in red.

3 Year Time Frame

To start off with the 1st table, for a time period of 3 years, the odds are very much against you to even earn a 12% CAGR return in the headline indices. The factor based indices increase the odds but not by much. It is interesting to see how the probabilities reduce for the largecap indices when we compare the total dataset with that of the recent decade. The midcap and microcap indices show the greatest improvement in probabilities in the last decade.

Conclusion: The NSE200MOM30 is the best bet based on the last decades data.

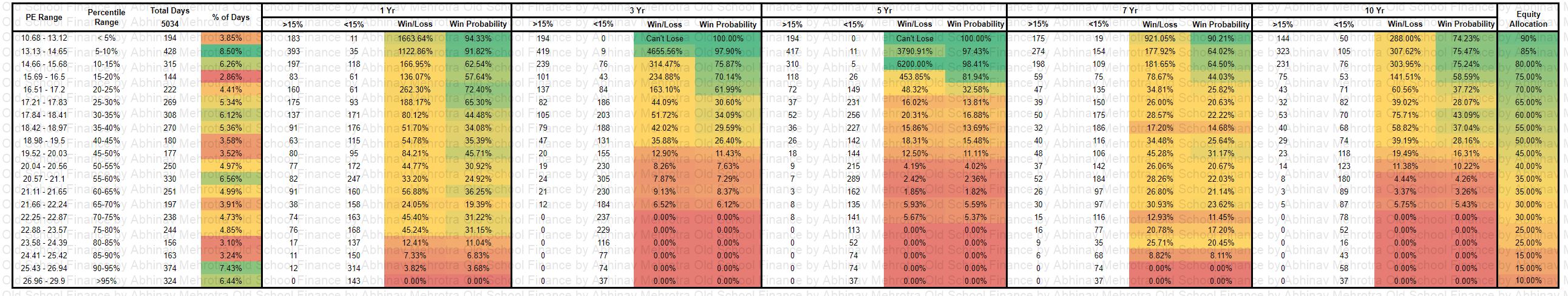

5 Year Time Frame

Over a 5 year time period, the probabilities just crash overall, I am not sure what is the reason for this divergence. In the more recent decade, the difference is even starker. This paints a very grim picture for investing for 5 years in Indian indices.

I would love to discuss this with my peers and market veterans as to what may be the reason for this divergence.

There was an error in my calculations for the 5-year figures which have been corrected now. It is no surprise to see that midcaps, microcaps and factors outperforming headline market cap based indices.

Conclusion: The NSEMICROCAP250 is the best bet based on the last decades data. The NSE200MOM30 is the best bet based on the last decades data.

7 Year Time Frame

Over a 7 year time period, the Indian markets redeem themselves from their poor performance over the 5 year time periods. The probabilities are heavily in your favor if you skip the main large cap indices and pick midcaps, microcaps and factor based indices. NIFTY NEXT 50 deserves a special mention here as it shows the odds in your favors in both recent past and since inception.

The factor indices hit the ball out the park when we consider the recent decade, the odds couldn’t be better than this. But it remains to be seen whether such performance will continue into the next decade or will they fall prey to mean reversion.

Conclusion: Over the last decade, you could have picked the midcaps, microcaps, NN50 and factor based indices and would have easily earned more than 12% CAGR with near 100% surety.

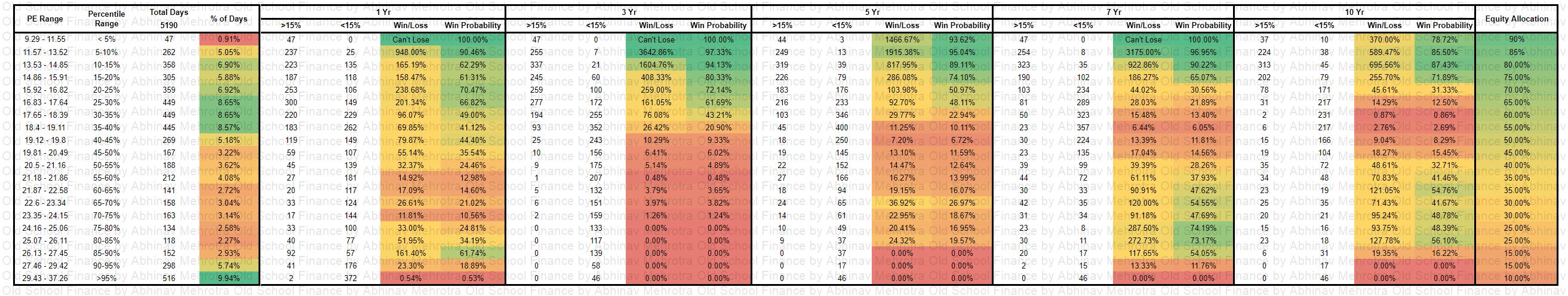

10 Year Time Frame

For the 10 year time frame, it is more relevant to look at data from inception as the time series is longer. I have included the probability data from the last decade but there are only 342 10-year rolling periods and drawing any conclusion from this small dataset is not advised.

Here again, the factor based indices outshine the market cap based indices with the exception of NN50. The midcap index was basically a flip of a coin.

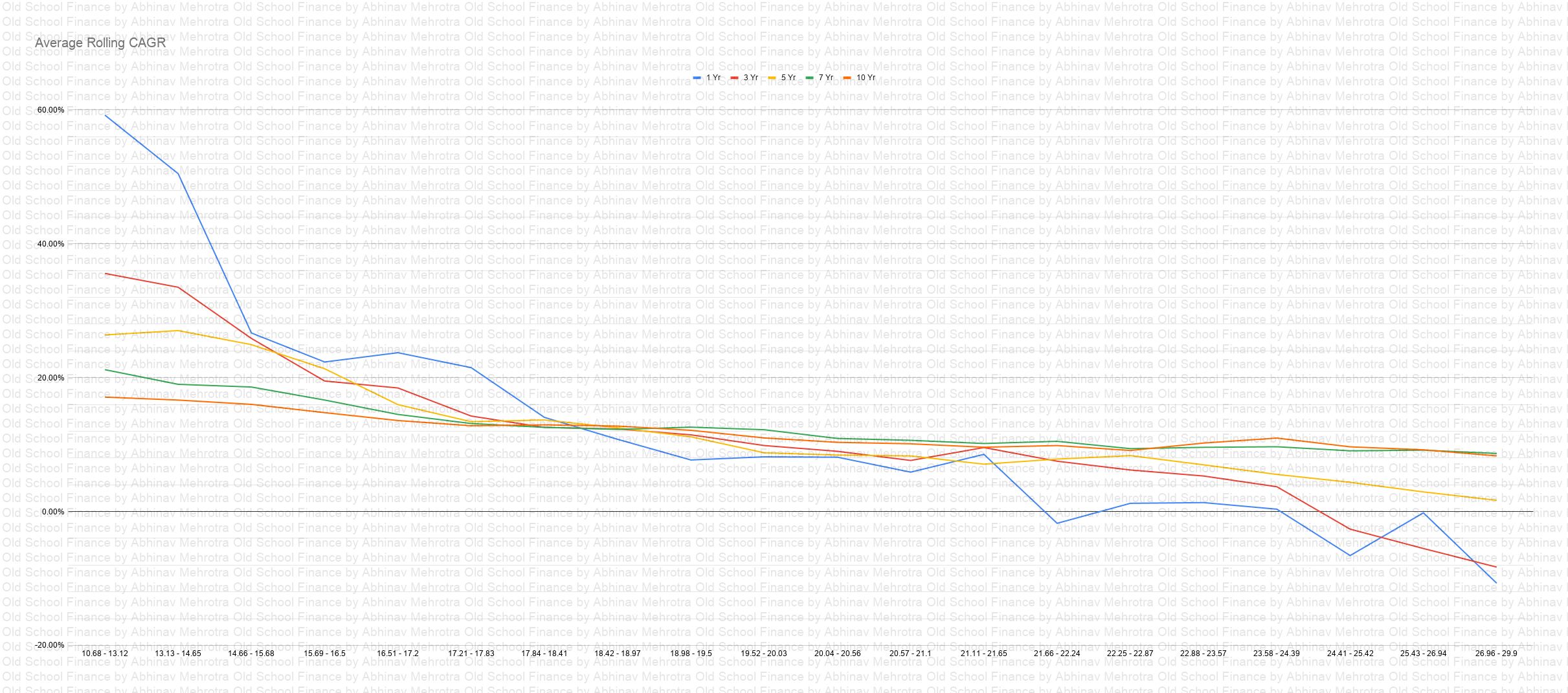

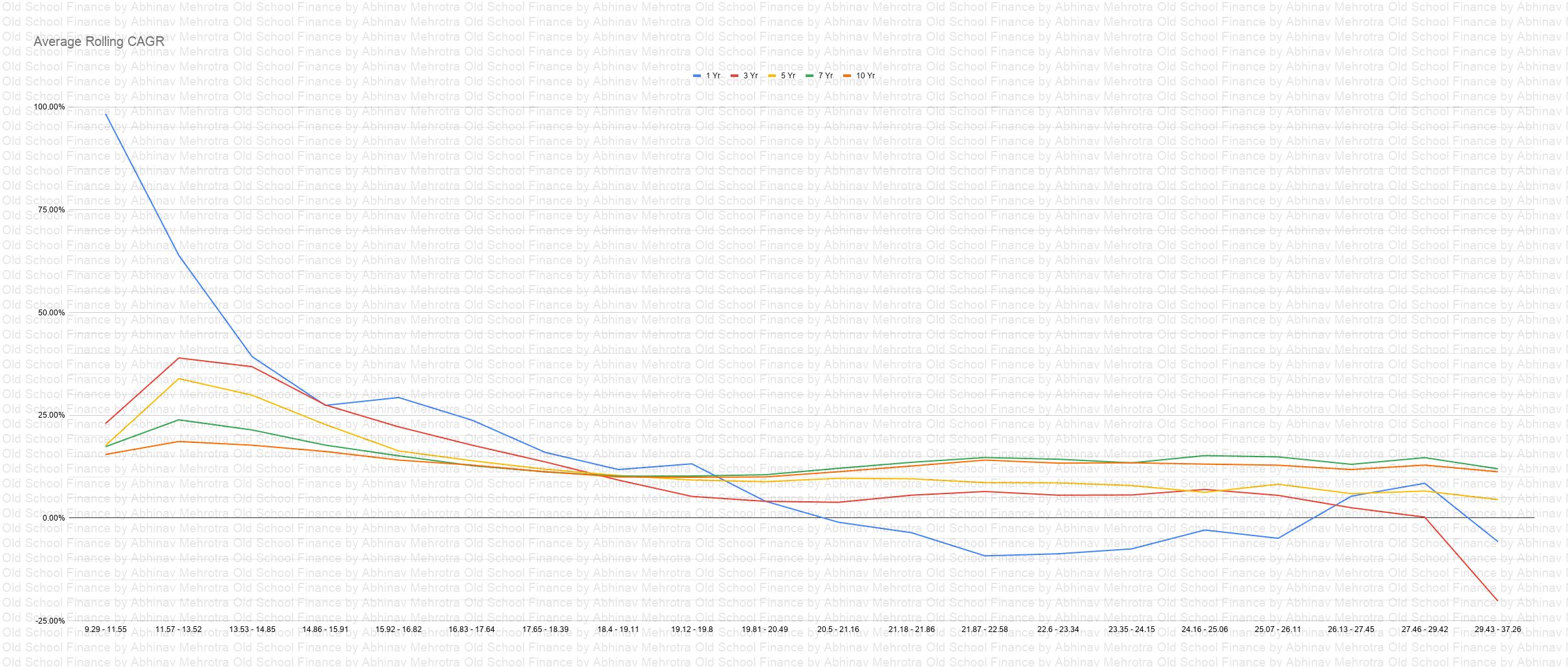

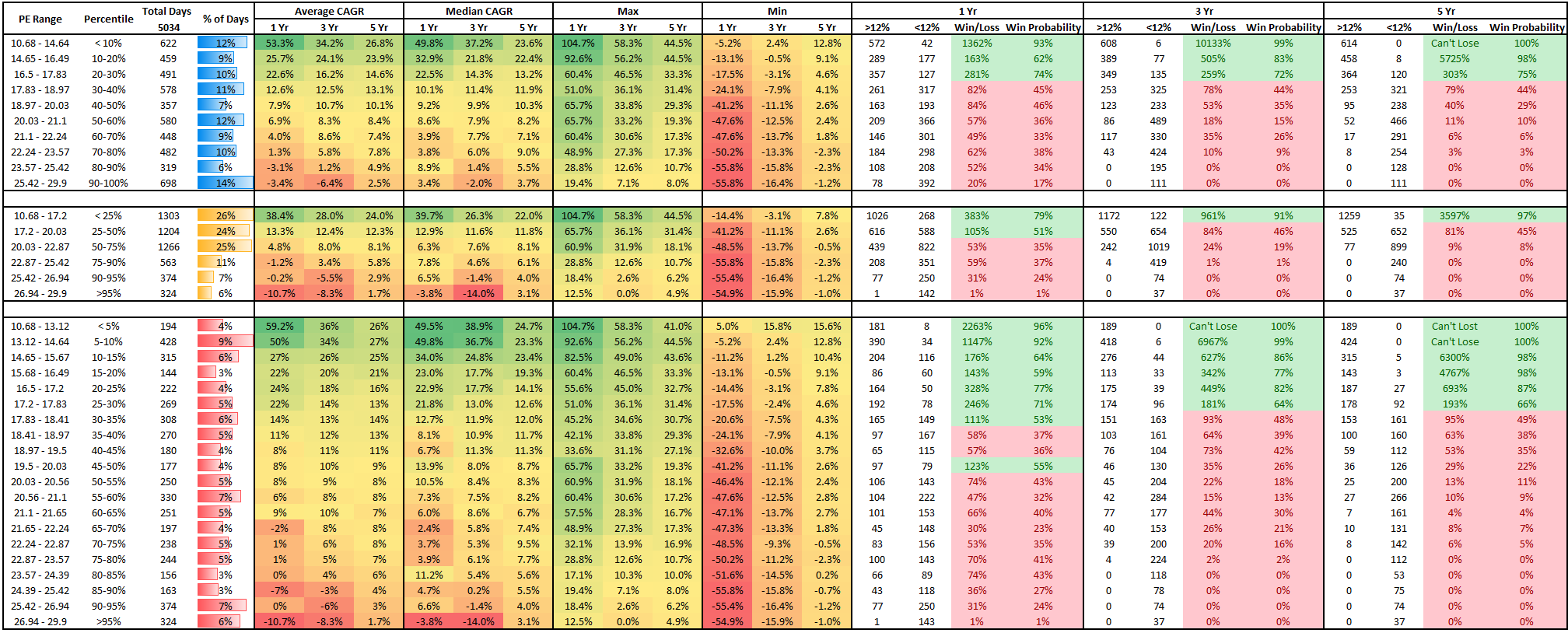

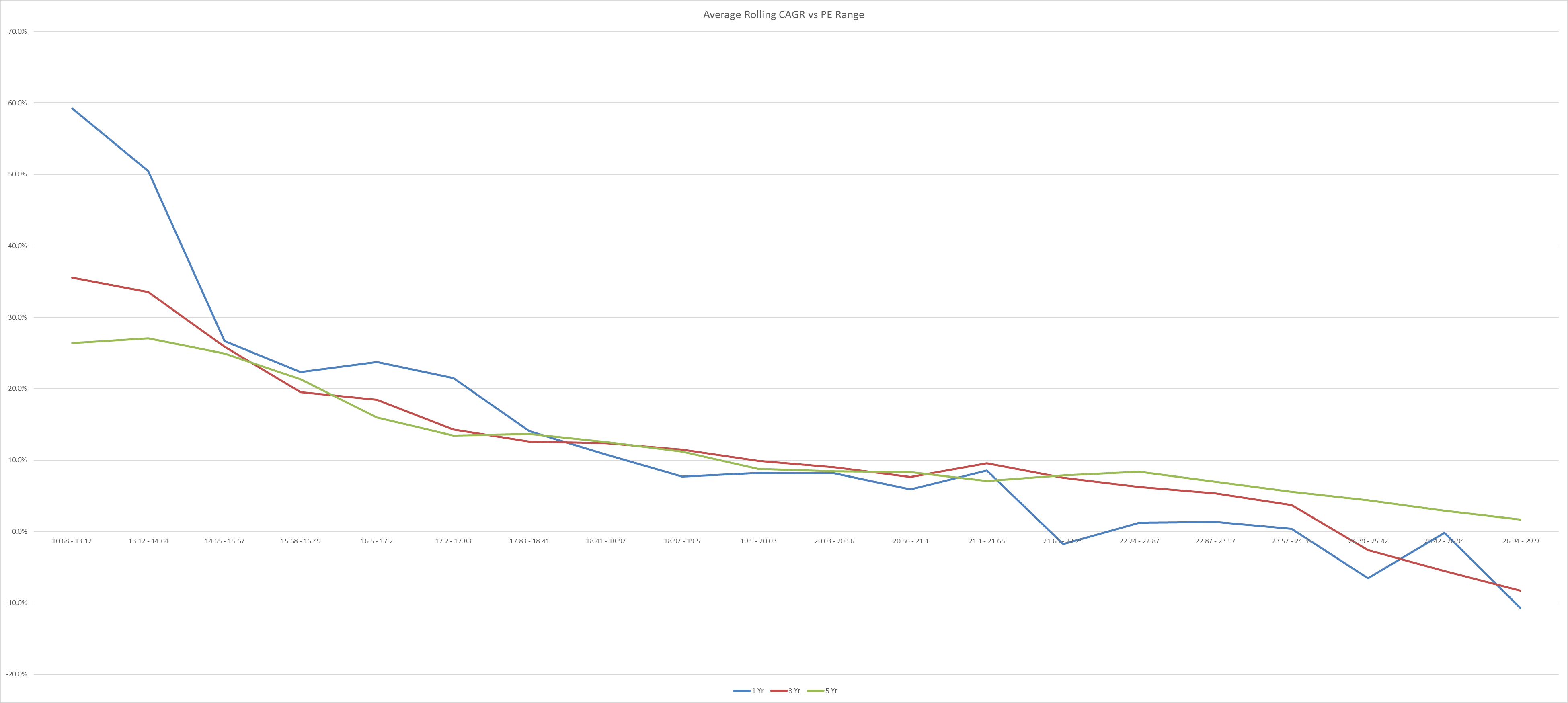

Average Rolling Period Returns

In the last two tables, I have shared the average rolling period returns for the same indices for 1/3/5/7/10yr time frames. Again I have used different data sets, one from the latest decade and another from inception.

Averages have a way of hiding the ups and downs of an index. If you want even more data on the maximum, minimum returns in these periods, their standard deviations etc. you can use the sheet I have linked below.

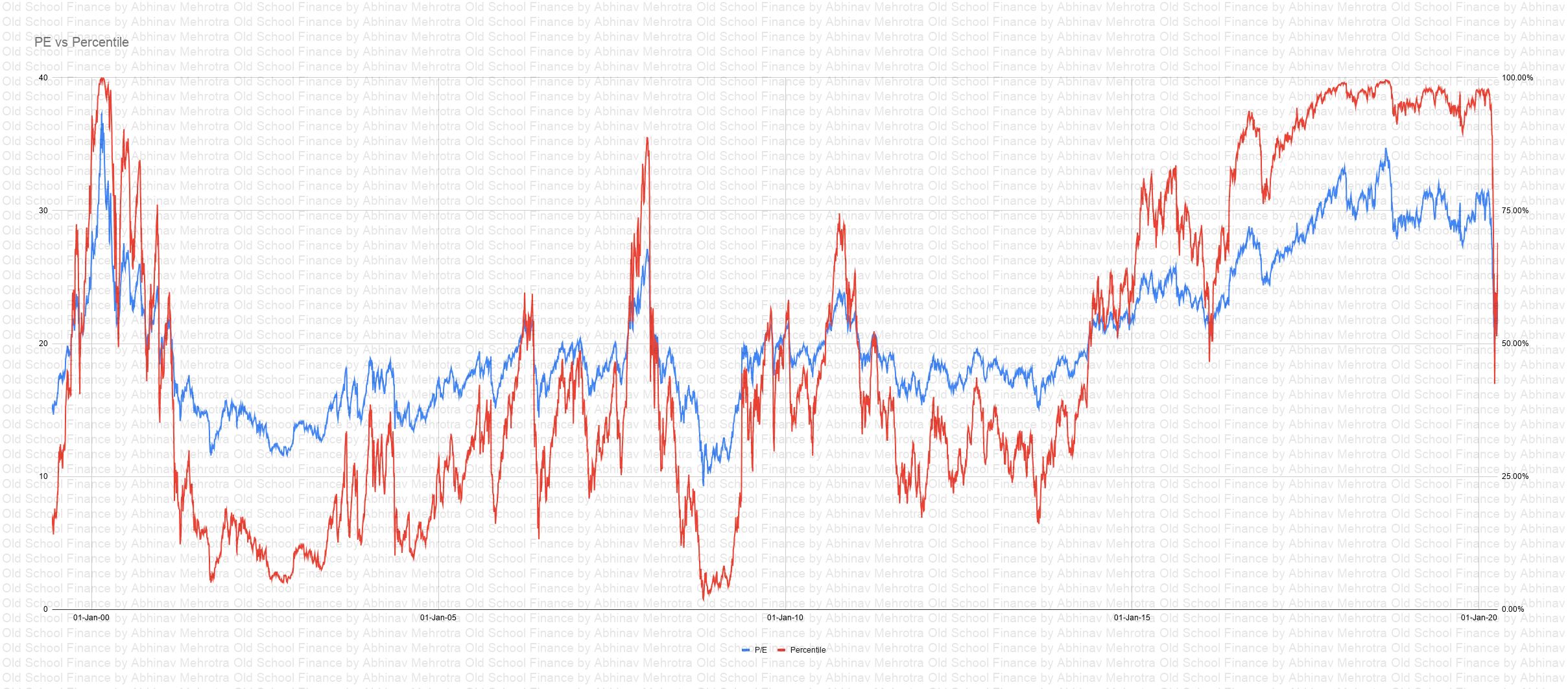

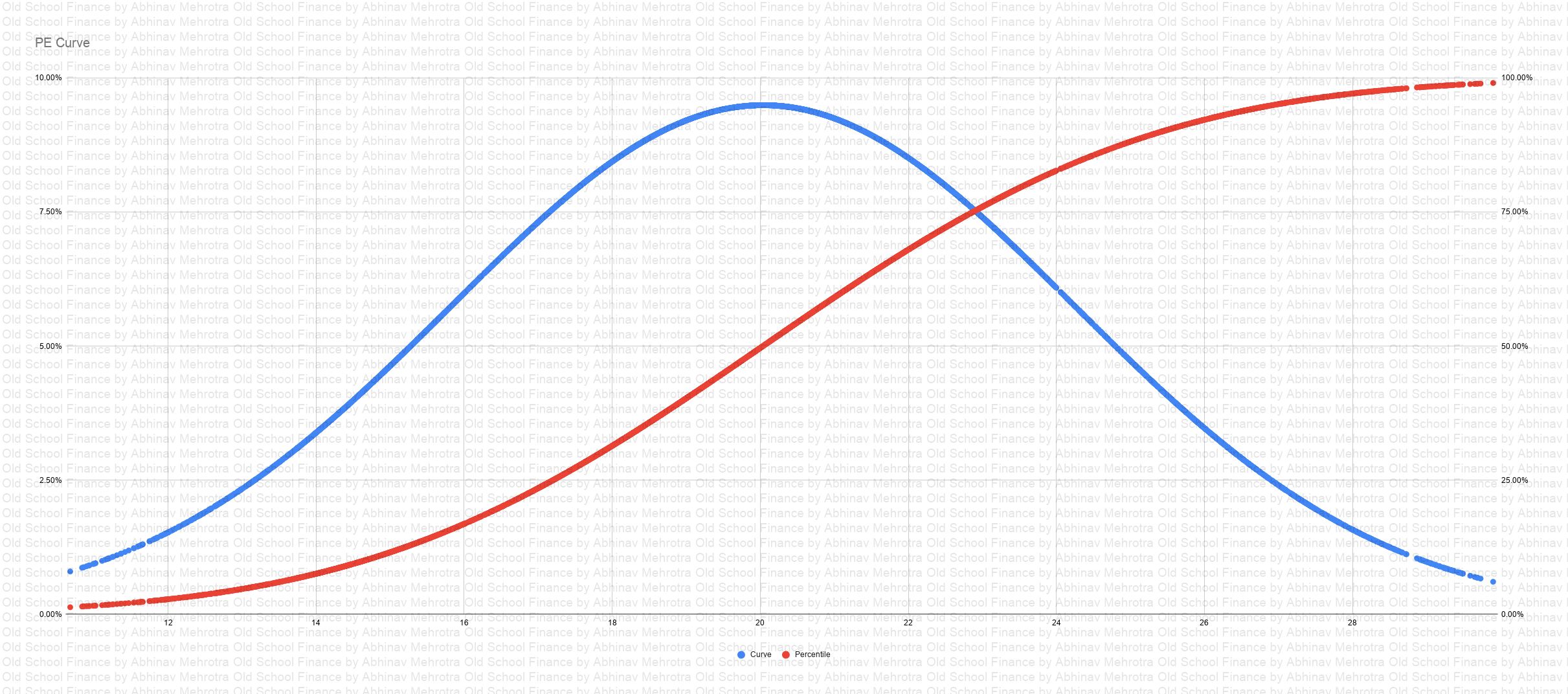

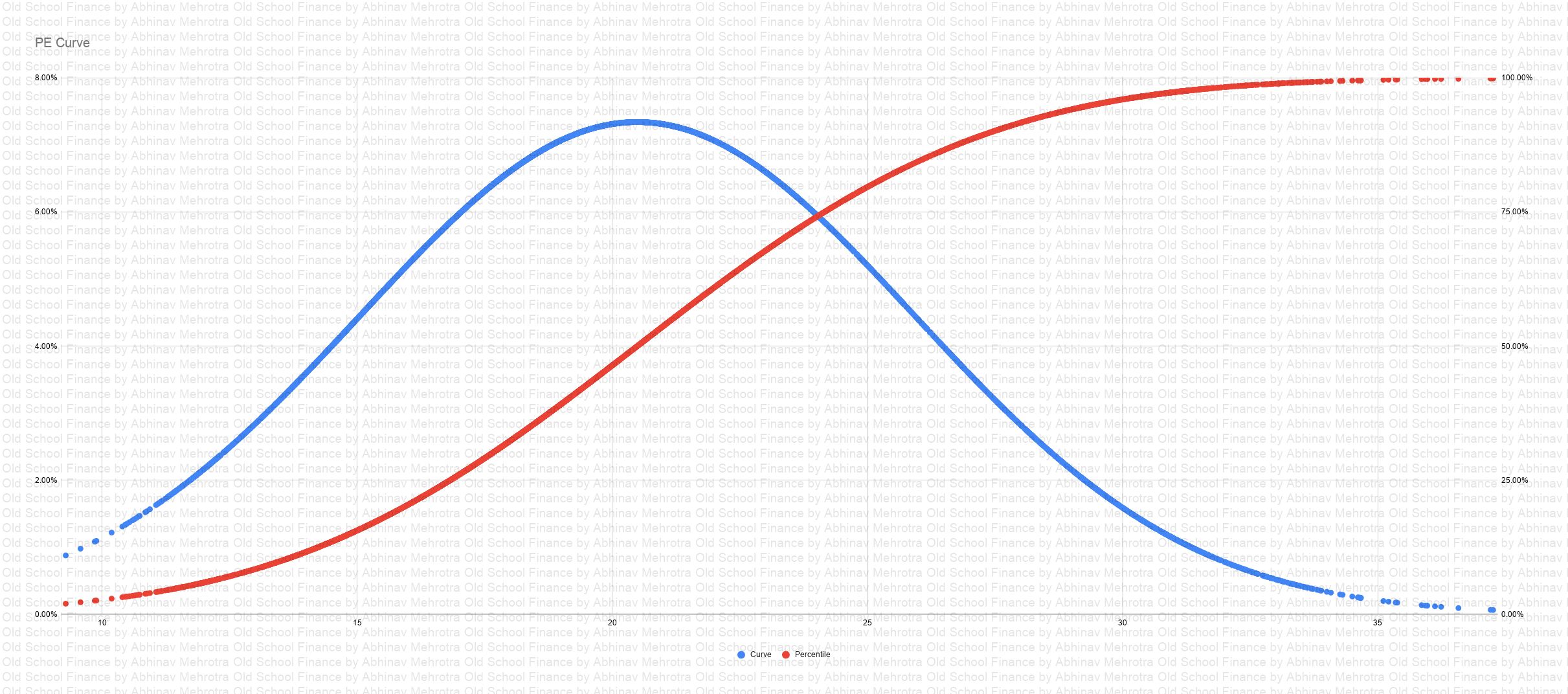

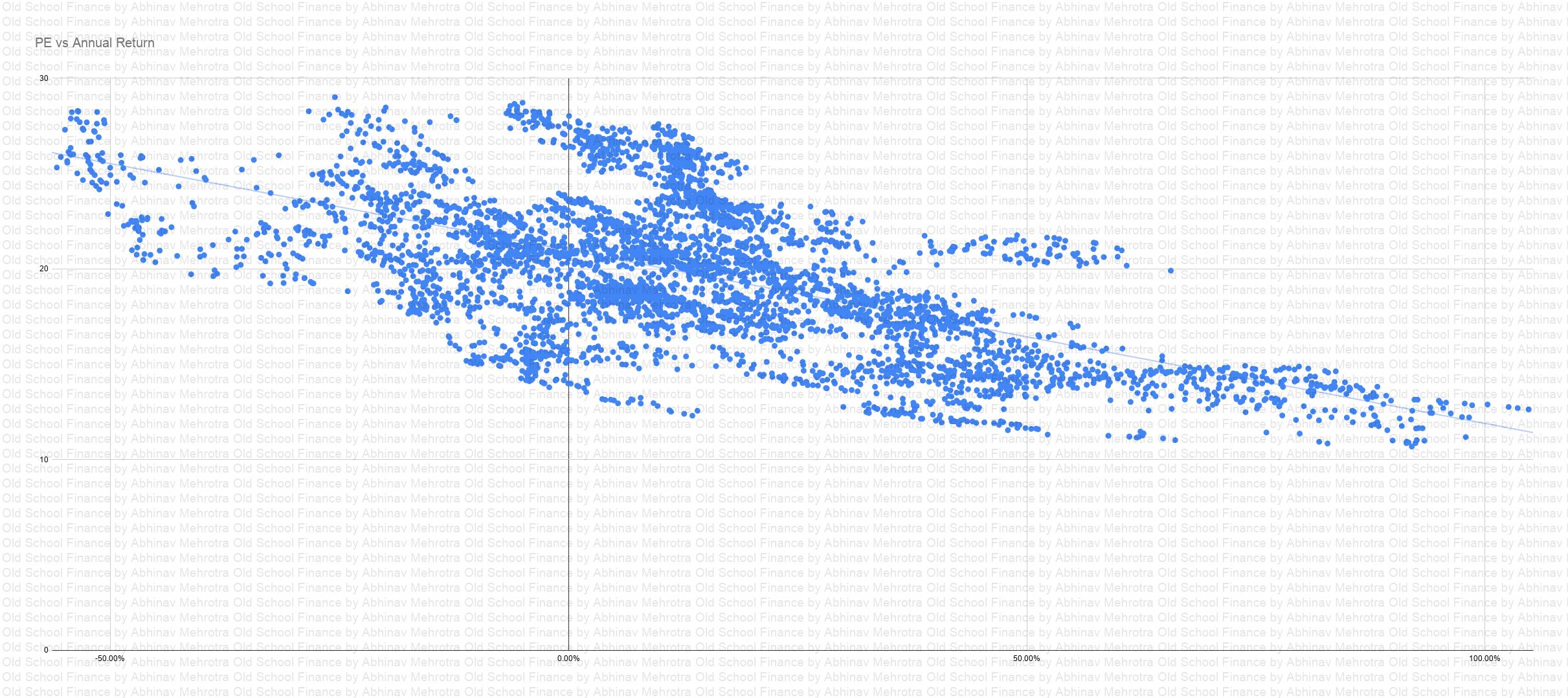

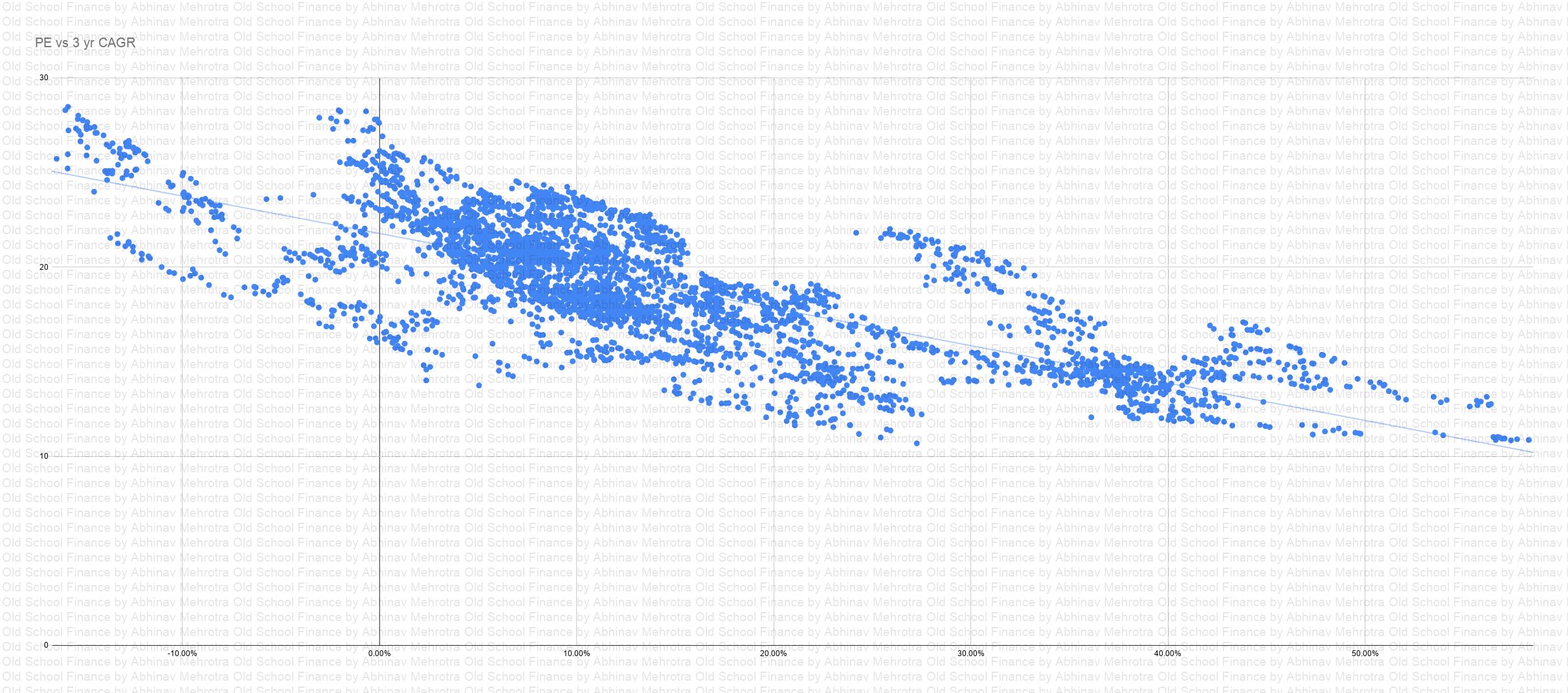

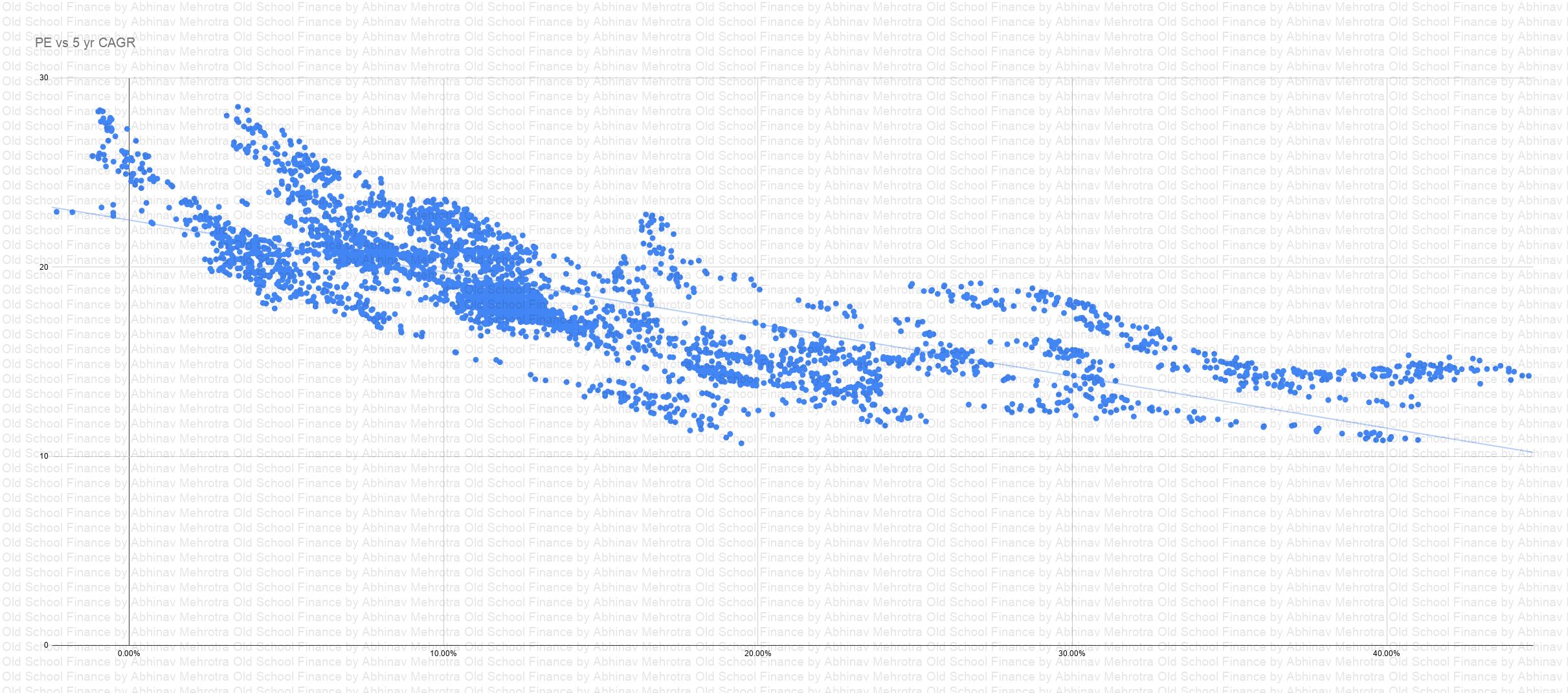

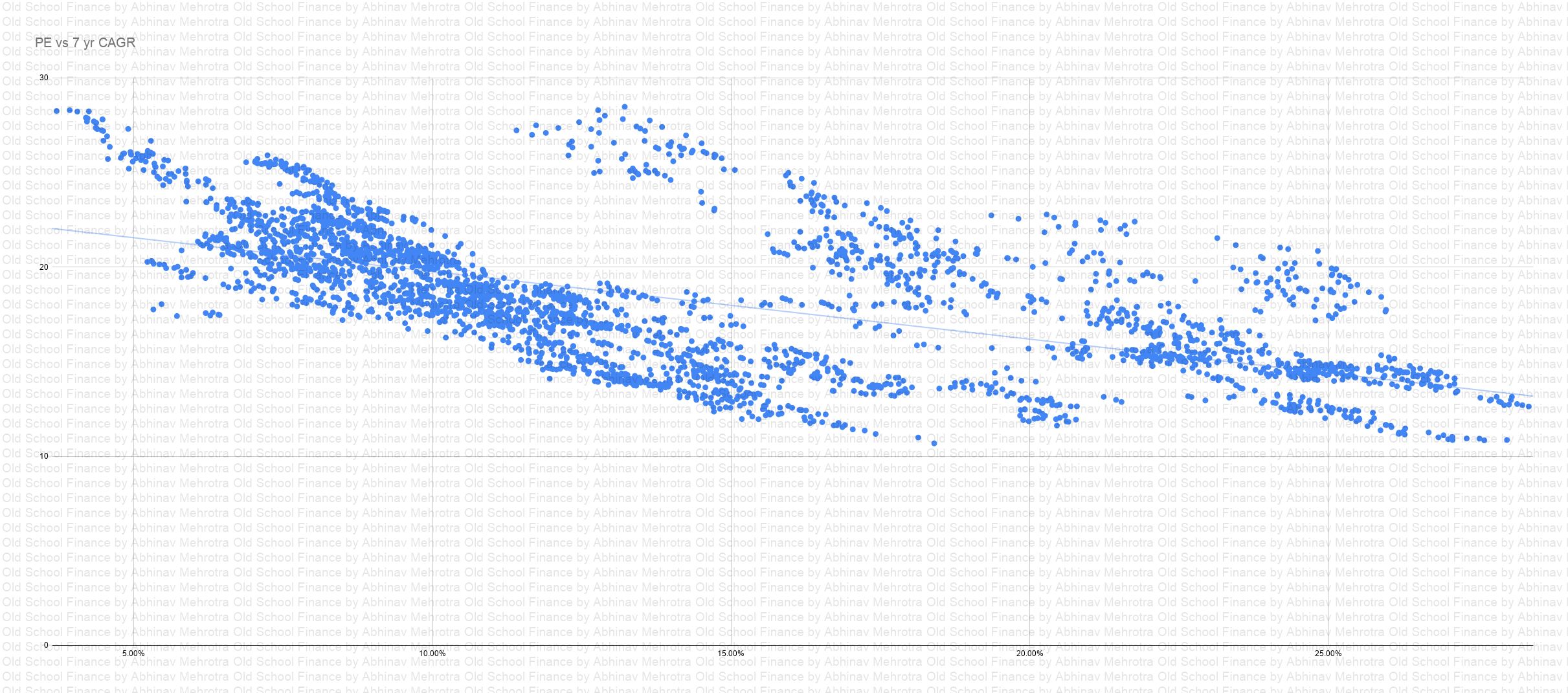

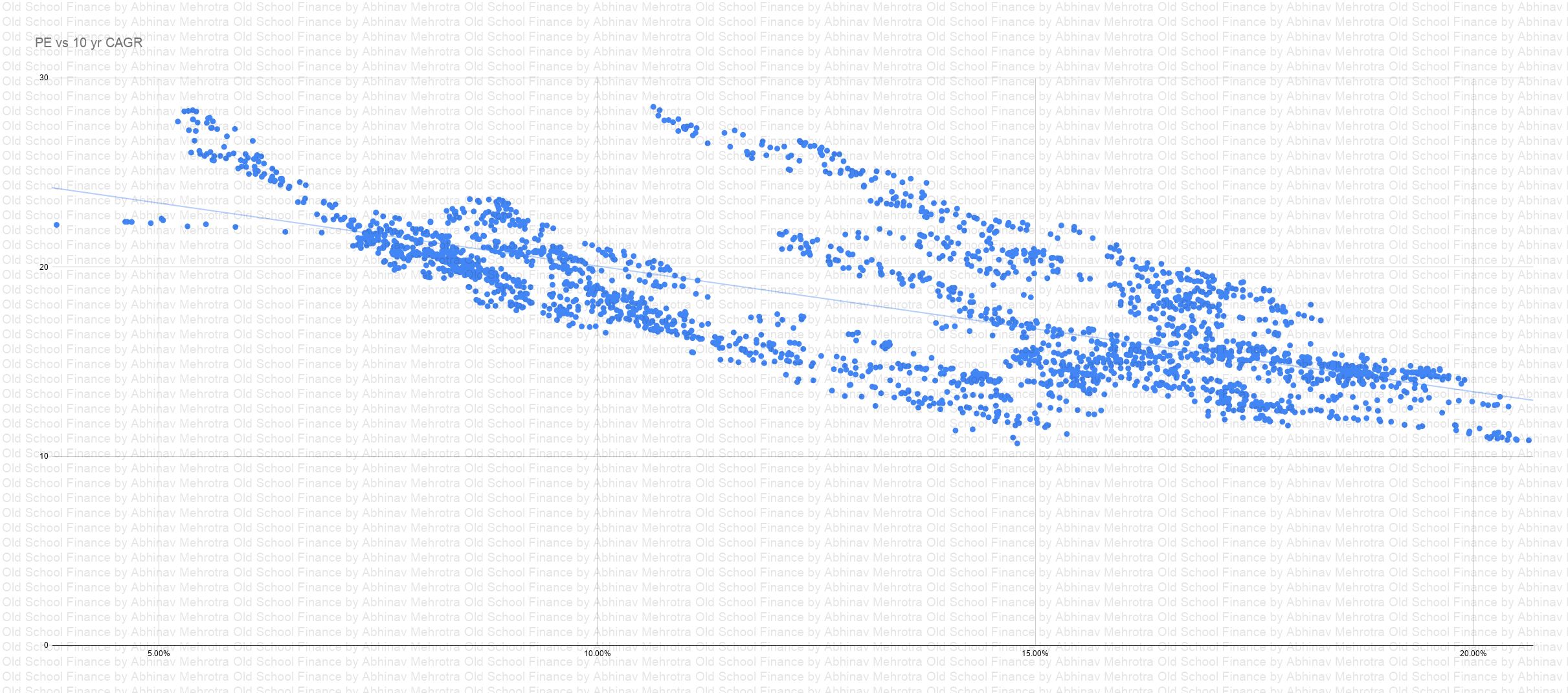

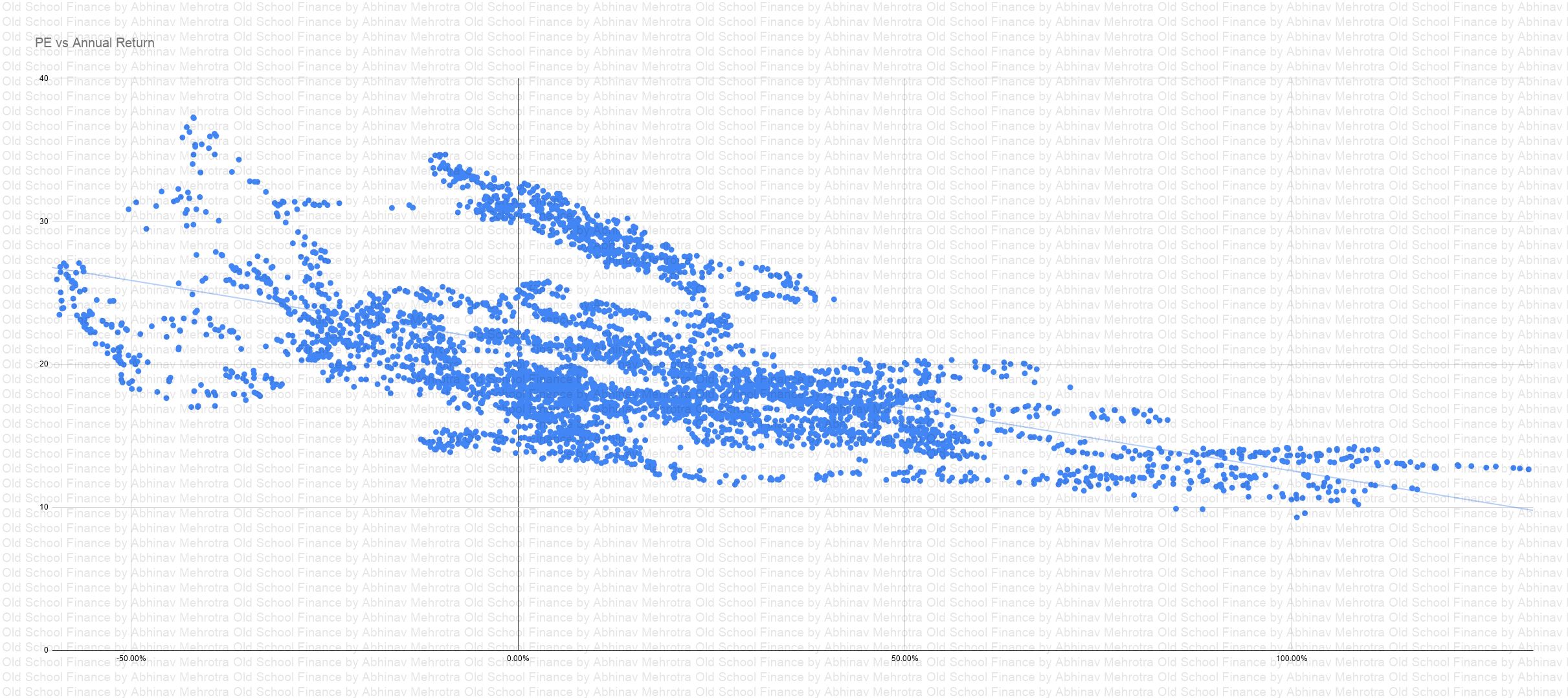

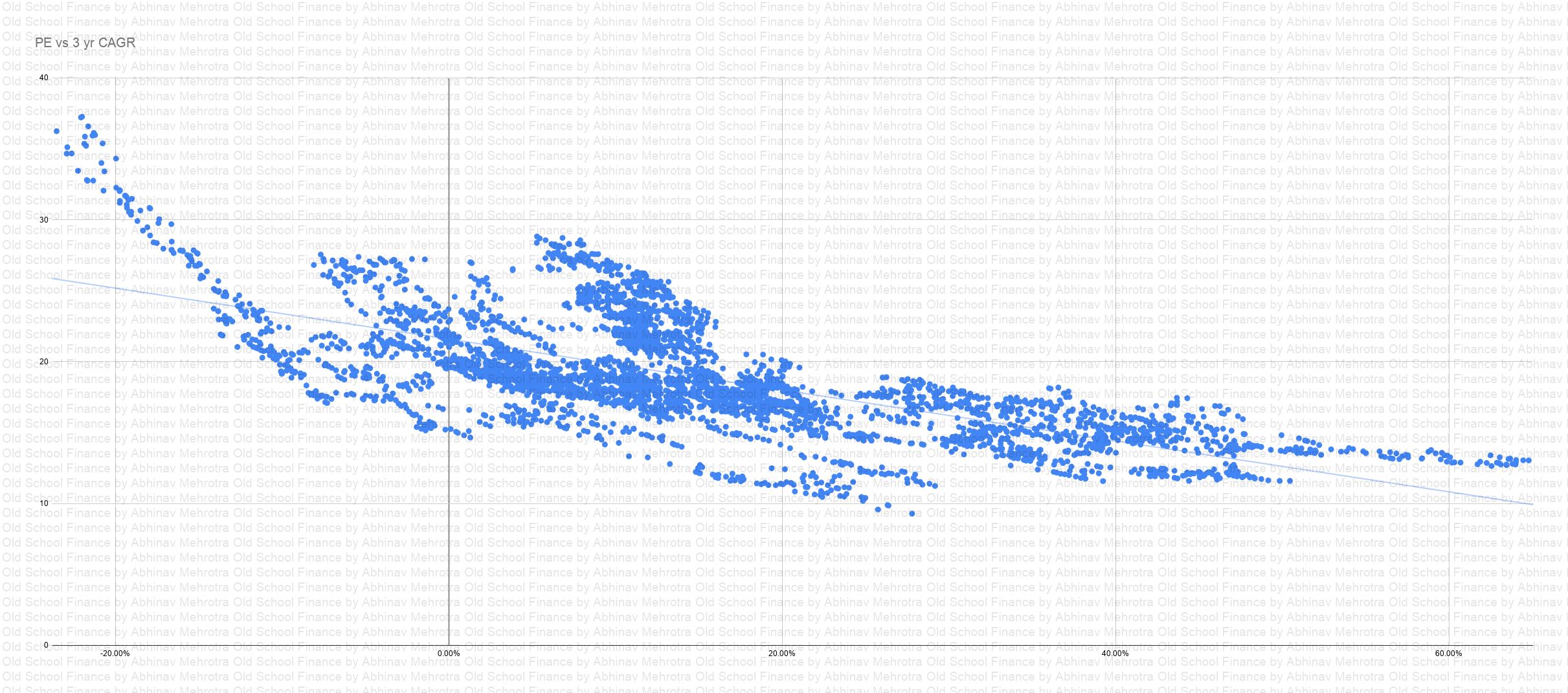

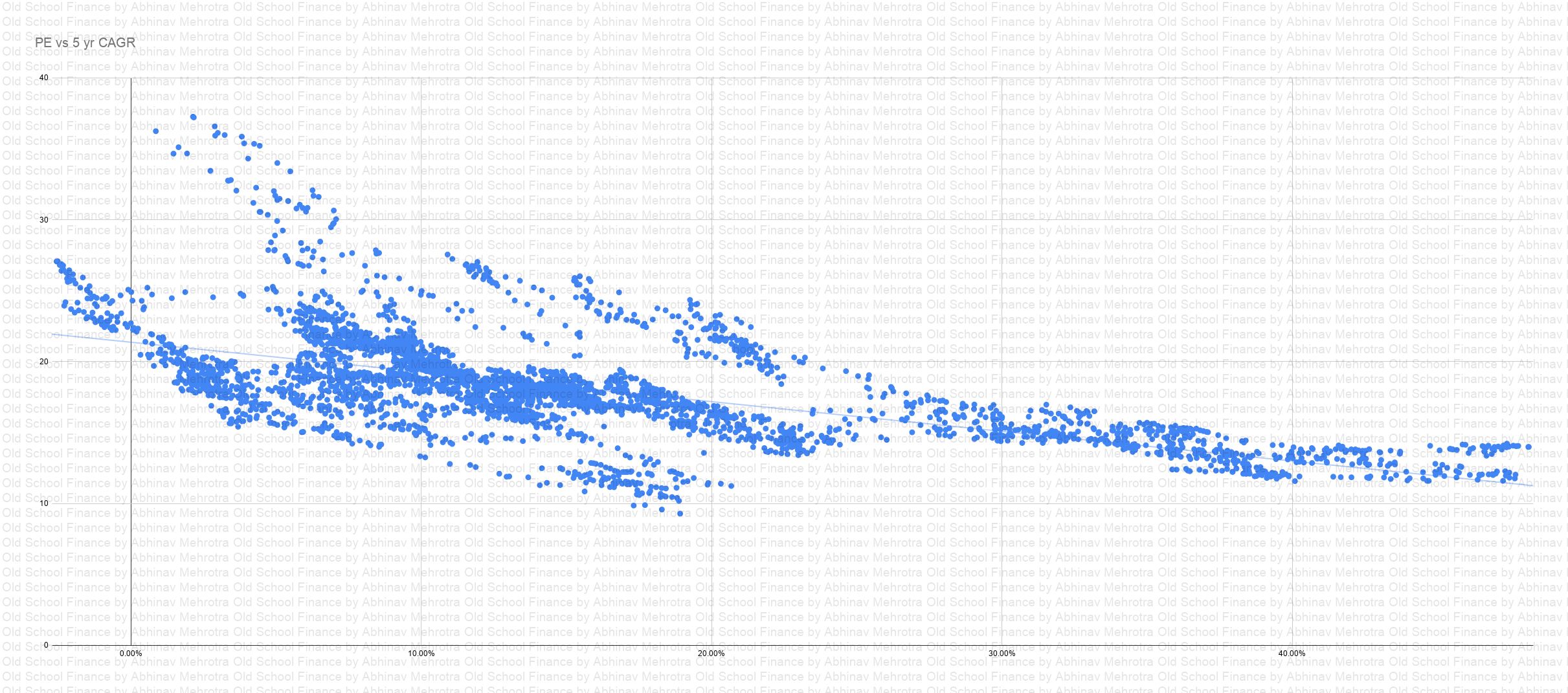

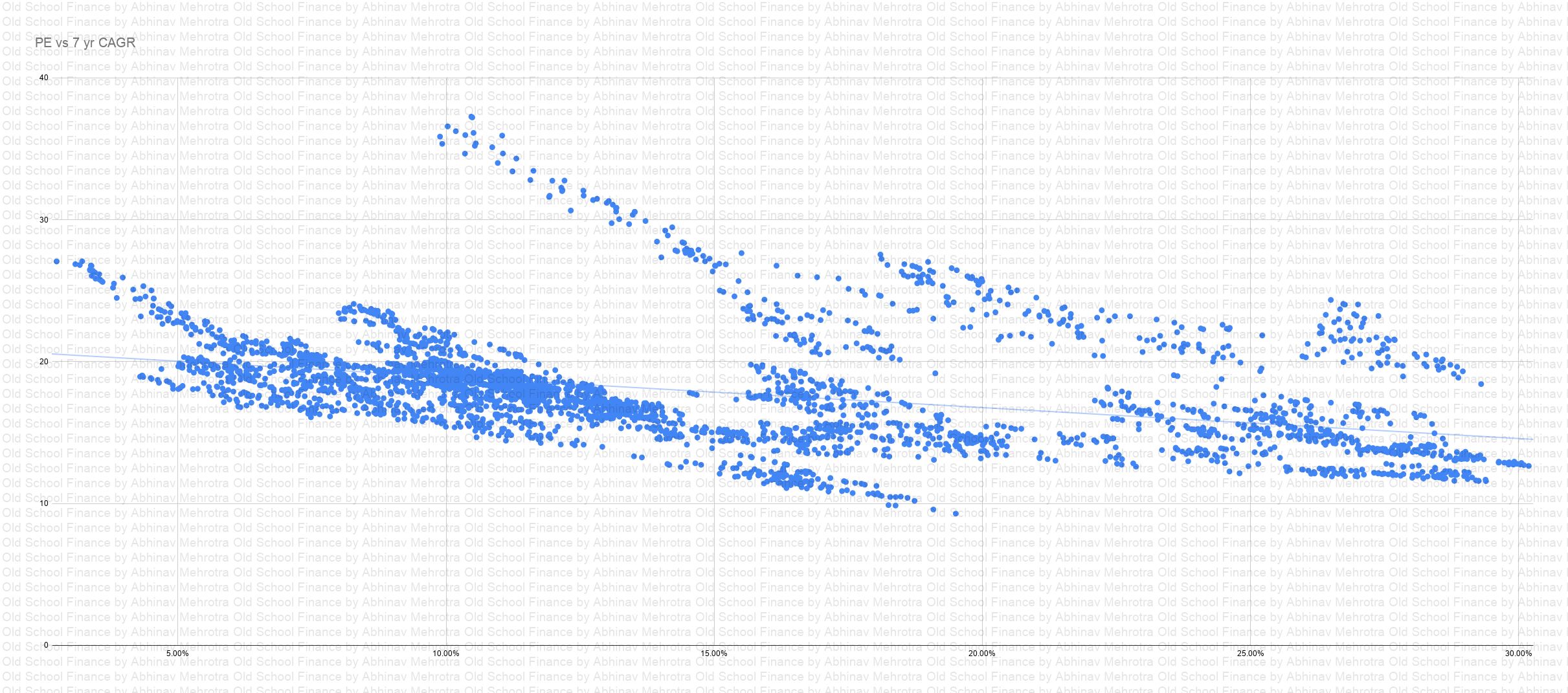

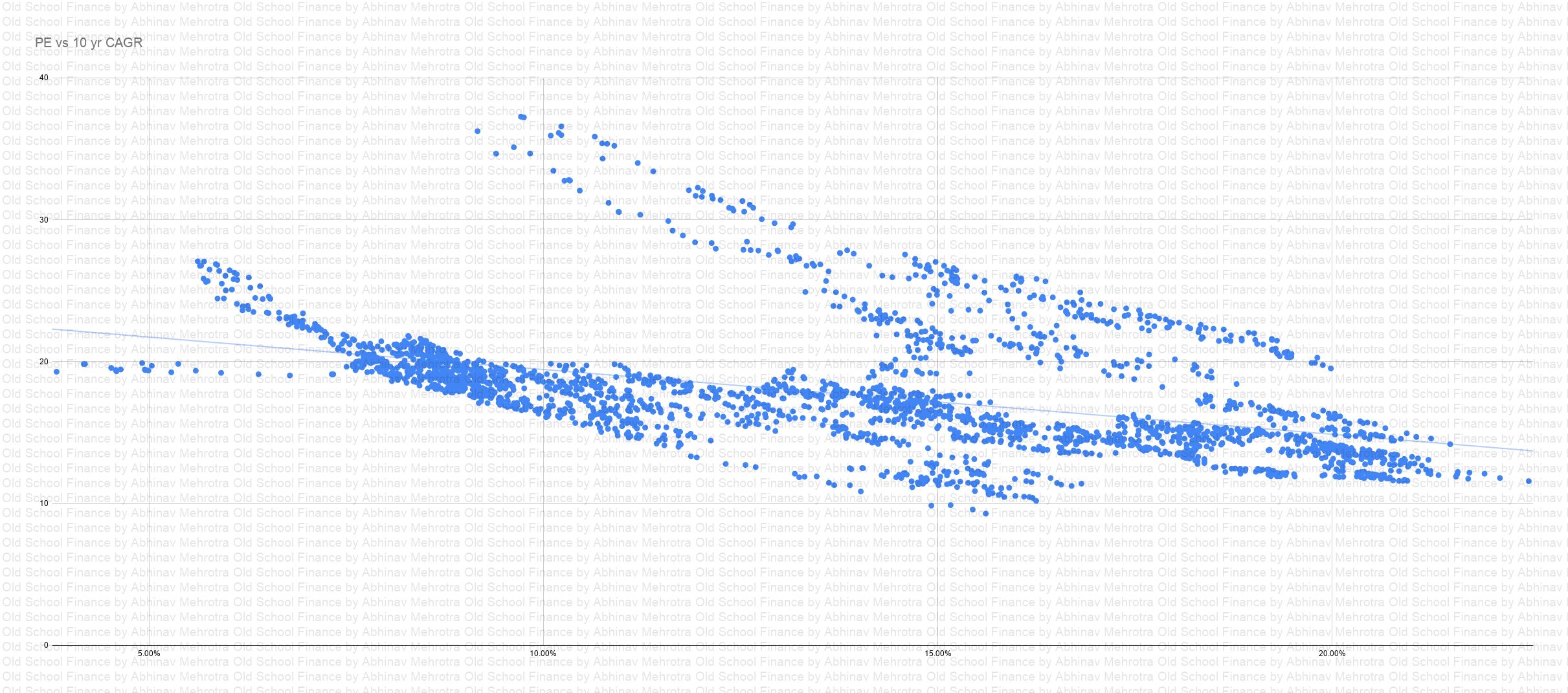

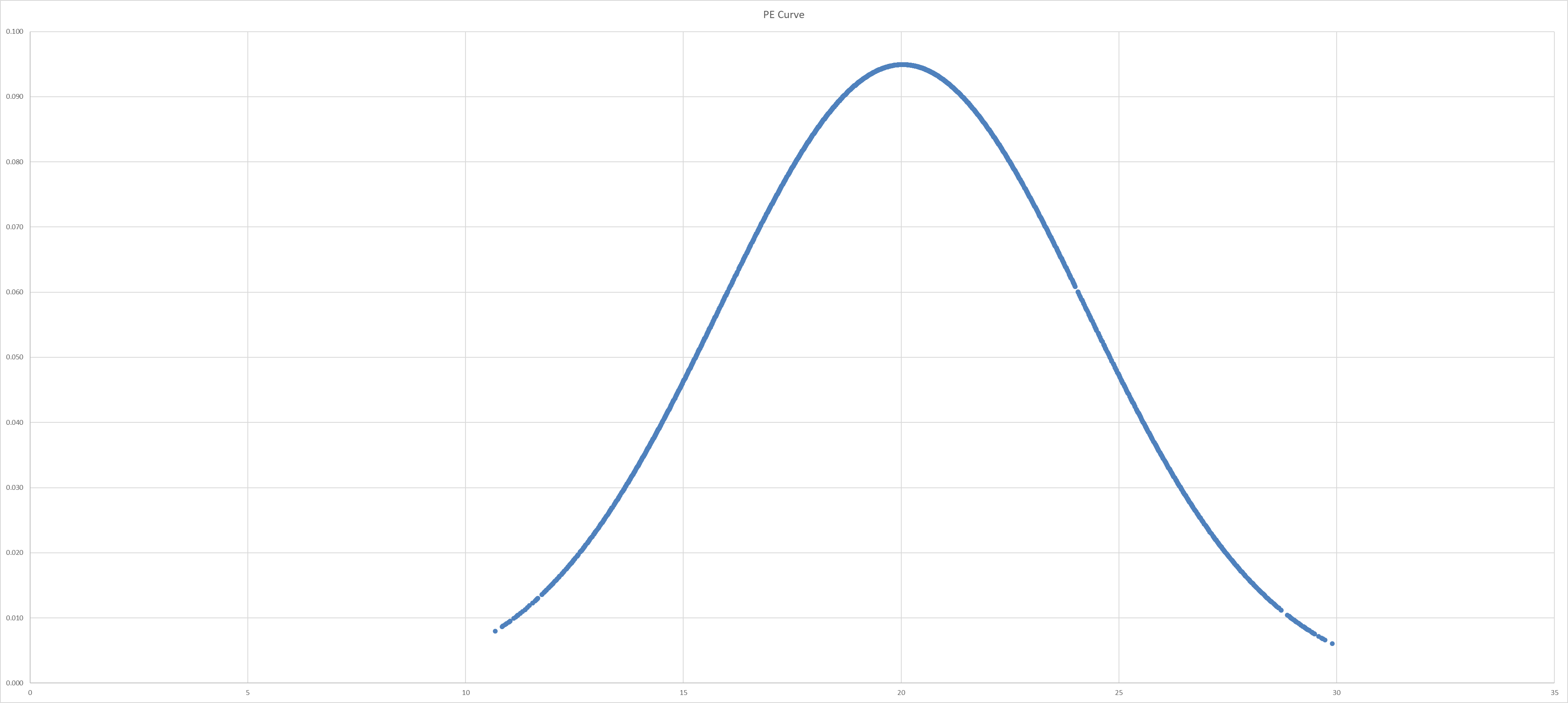

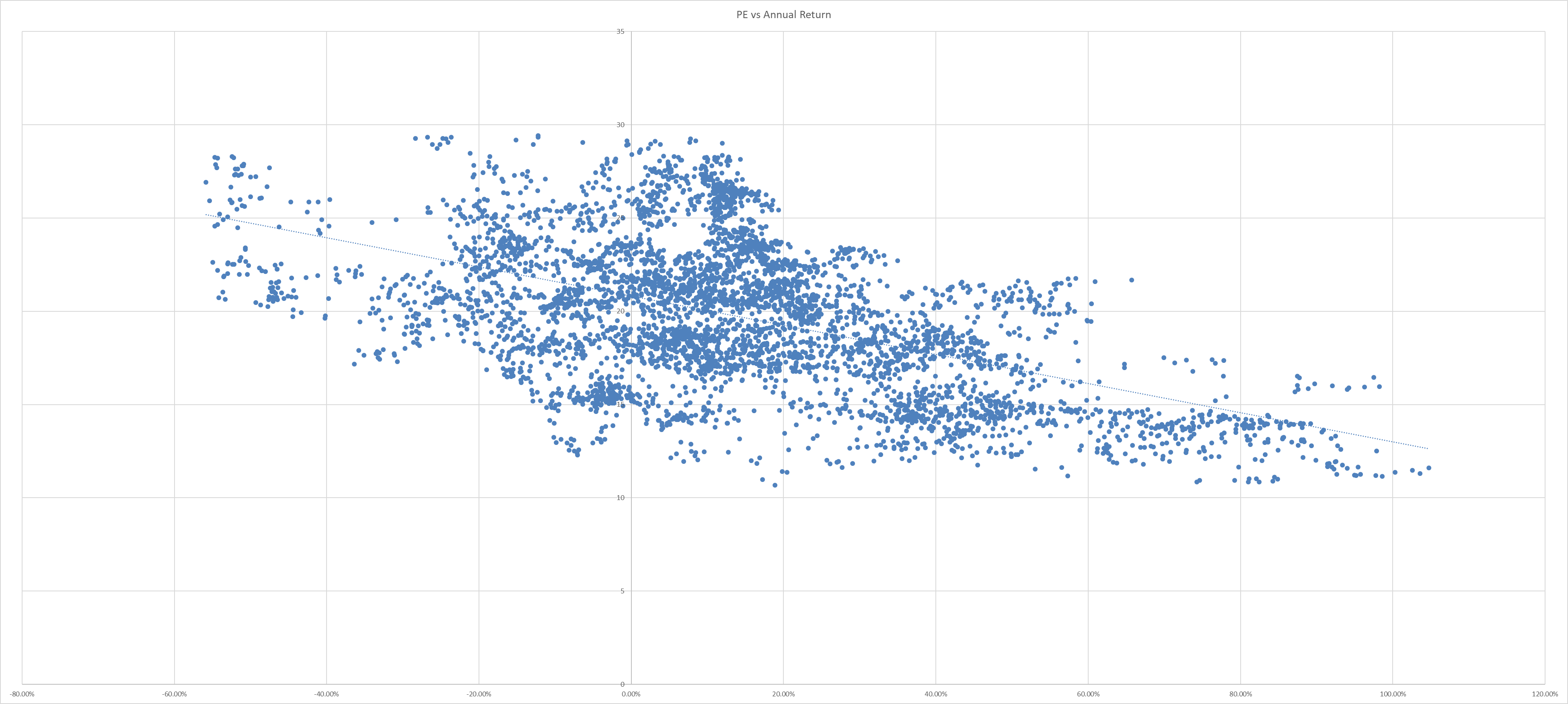

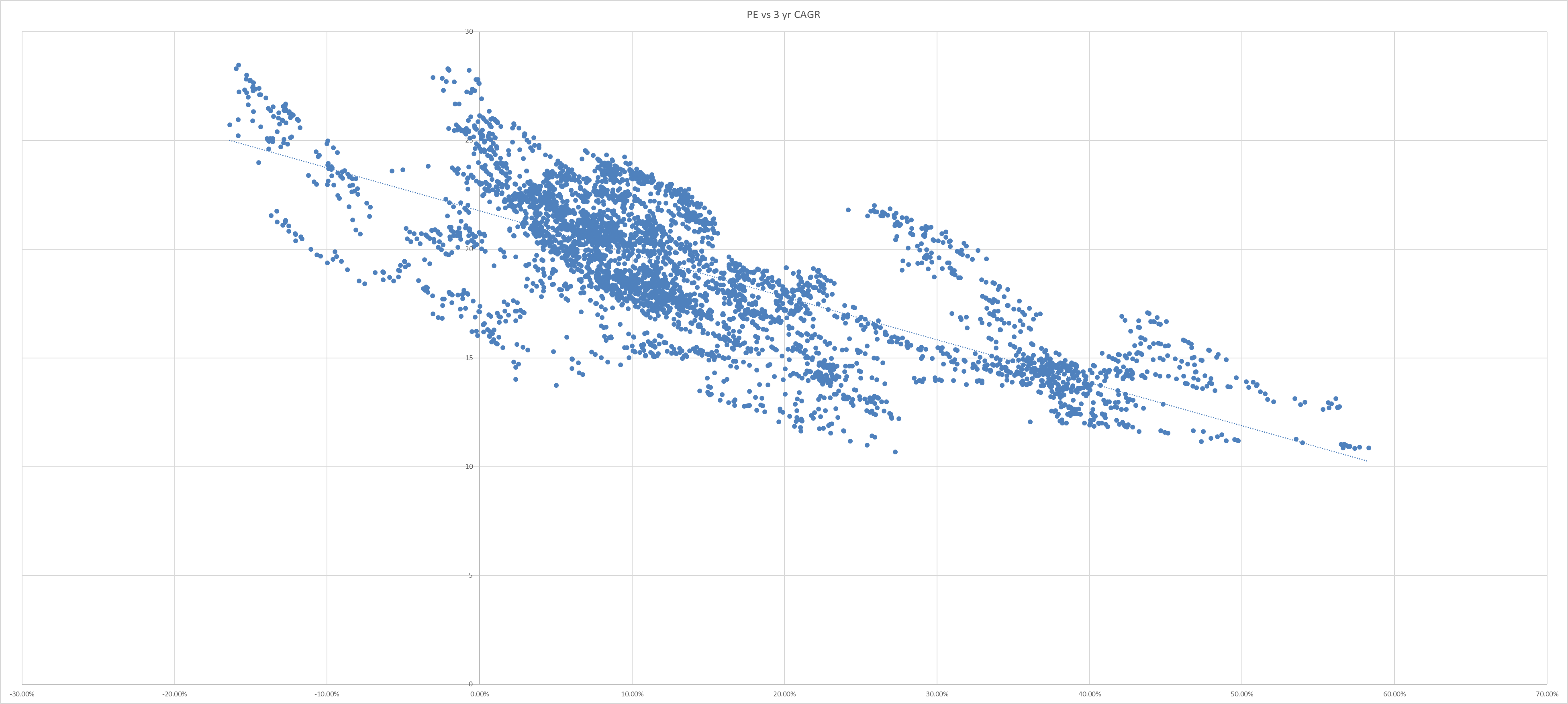

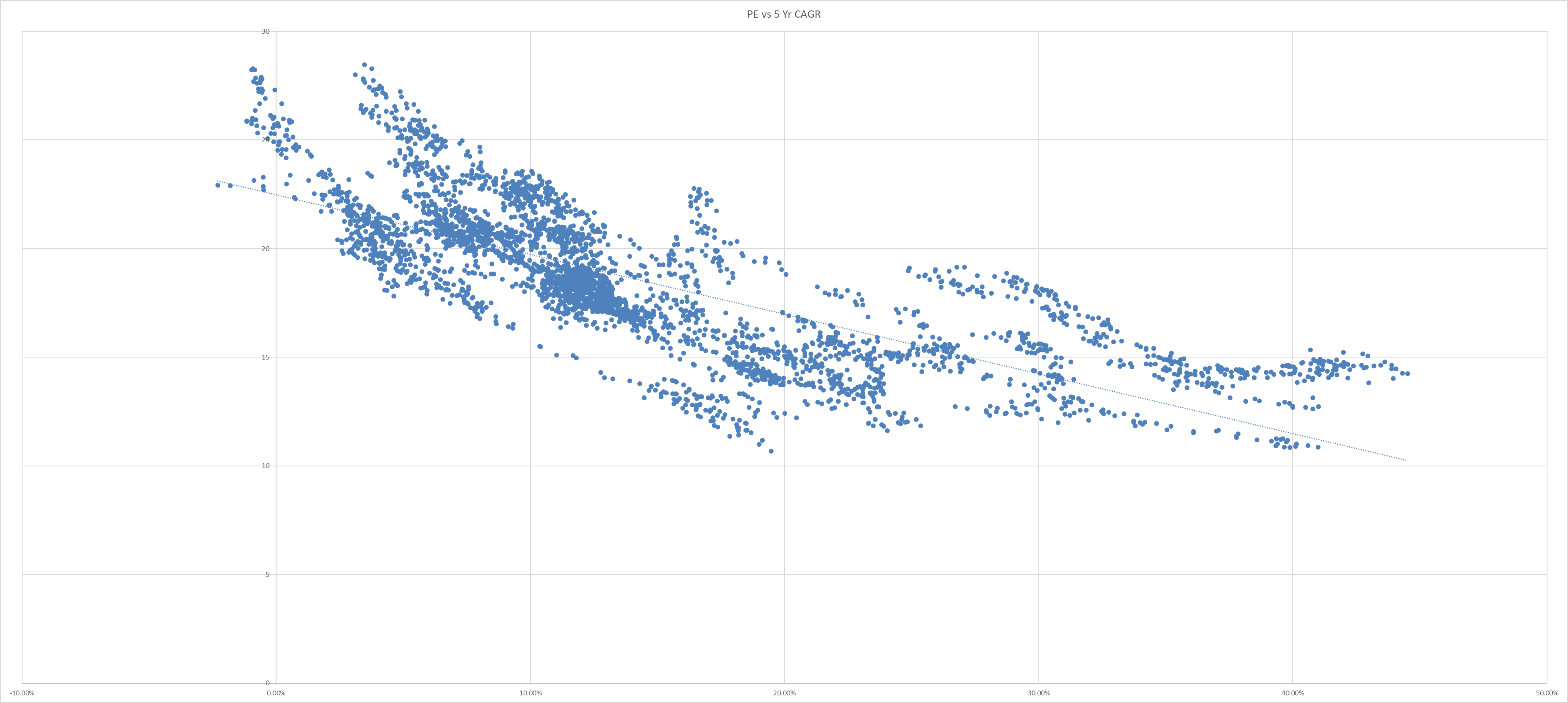

In a more high level analysis, I have already shared the link between PE and the rolling period returns for NIFTY50 & 500 indices in a previous blog post.

On an average basis, since inception the NN50 and factor based indices outperform the market cap based indices in all timeframes. If we consider only the last decade’s data even NN50 drops the ball and factor based indices just hit a home run in every time period.

Conclusion

Overall, it seems like the factor based indices are generating significant alpha over the market cap based indices. But whether the historical outperformance will continue is anybody’s guess. The odds are surely in their favor. Factor based investing has just started in India, and it will be no surprise if more capital chases this outperformance in the next decade.

However, with size will come impact costs and as factor based AUMs get larger I believe the alpha generation will slow down. But given the difference in current AUMs, this problem should be a long way off.

Google Sheet: https://docs.google.com/spreadsheets/d/17fLhGV_lBmRbdiNlf2SAvg0Q7JrBiK_OamFlVYhnuWY/edit#gid=744304526

Disclaimer:

- The data on Google Finance is only available for the first 5 indices and has different start dates to the data with NSE.

- While we have tried to maintain the data accuracy, we can in no way guarantee that the data is 100% correct.

- Please do not treat this as investment advice. We have only provided you with the data to make your own well informed decision. We in no way are recommending one investment product over another in this blog.

- We have not considered the impact of expense ratios on the indices’ returns. Generally, expense ratios for normal index funds will be lesser than or equal to that of factor based indices.